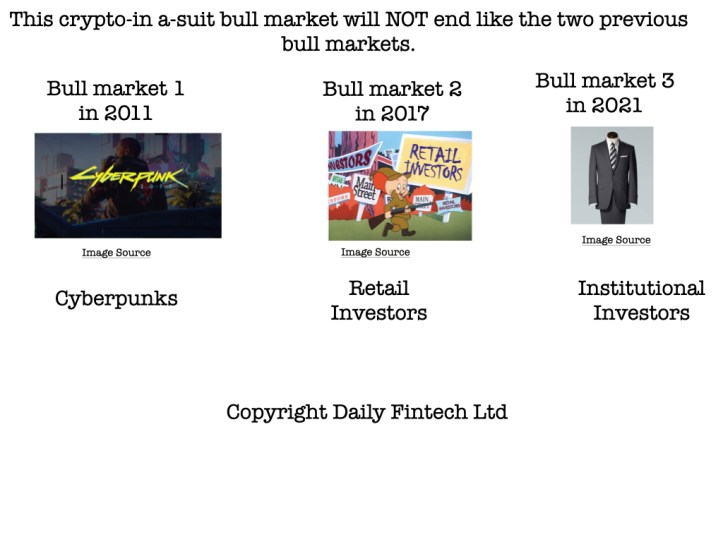

This crypto-in a-suit bull market will NOT end like the two previous bull markets.

We are in the crypto-in a-suit bull market, epitomised by Coinbase going public and joining the Fintech 50 Index last week.

A suit is the uniform of corporate life but we are not defined by our uniform. Years ago, during a crypto bear market I was at a conference of legacy finance folks. I was the token crypto bull on the panel. A fellow panelist said to me “I am representing a bank which is anti Bitcoin, but that is company policy not what I think”. In other words, humans may put on a suit but we are not suits.

We are currently in crypto bull market number 3:

- Crypto bull market number 1 was the cyberpunks in 2011. This was more about sticking it to the man than making money. A few of those cyberpunks bought below $1 and HODLED -a 60x return as write – and could buy an Institutional firm if they wanted to. This bull died because there were few cyberpunks and they did not have much money.

- Crypto bull market number 2 was the retail traders in 2017. This was about making money fast to buy a Lamborghini with lots of hype about when price will “go to the moon”. If they bought in the bear market from 2012 to 2017, sold before the 2017 blow off top or HODLED through the 2018 and 2019 bear markets they made money. Most retail traders got burned by buying high and selling low and so this bull market ended.

- Today’s crypto bull market number 3 is led by the institutions. Institutional money is sometimes misleadingly given the “smart money” label. They are certainly smart at getting fees from investors but not necessarily smart at getting in early on great investments. Somebody who bought Bitcoin before 2011 and held it to today is certainly smart. Which brings us to how this crypto bull markets will end.

All. Bull. Markets. End.

The narrative during bull markets that this time is different and this will be a bull market forever is of course BS. What nobody know is when and why a bull market ends. However we can be confident that this crypto bull market will NOT end like the two previous ones. Crypto bull markets 1 and 2 simply ran out of money as there were not that many cyberpunks or crypto retail investors and they did not have much money. That is NOT the problem for crypto bull market 3 as institutional traders have plenty of money. Institutional traders will continue putting money into Bitcoin as long as they have confidence in two things:

- They can sell Bitcoin to retail investors. That is what institutional traders do for a living. As long as BTC price goes up this is possible, but those institutions still have to convince retail investors that their centralised on ramp to Bitcoin is better, faster, cheaper, easier than buying Bitcoin natively on it’s decentralised blockchain network.

- The regulators in a major jurisdiction like America will NOT ban Bitcoin. If they do ban Bitcoin, the institutional firms will exit Bitcoin fast. The cyberpunks would simply ignore the regulators and millions of retail investors are hard to shut down, but institutional firms exist at the pleasure of regulators and governments.

If you see institutional firms losing confidence in either of those two things, you know this crypto bull market is ending.

The bellweather will be Coinbase and other firms in the Fintech 50 Index who are pro Bitcoin (= most of them now).

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.

coinbase direct listing ETFs fintech 50 index Fintech General IPO