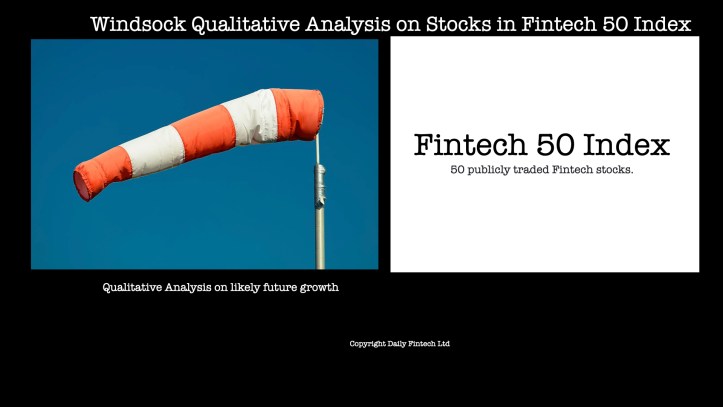

Windsock Score for Lemonade ($LMND), a member of the Fintech 50 Index of publicly traded stocks.

Windsock Score is our qualitative rating of companies in the Fintech 50 Index. We expect investors to use this together with quantitive analysis. We call it Windsock because we are looking for both headwinds (strategic obstacles to growth) and tailwinds (strategically well positioned for growth). We start with Lemonade ($LMND), the only member of the …

Read more