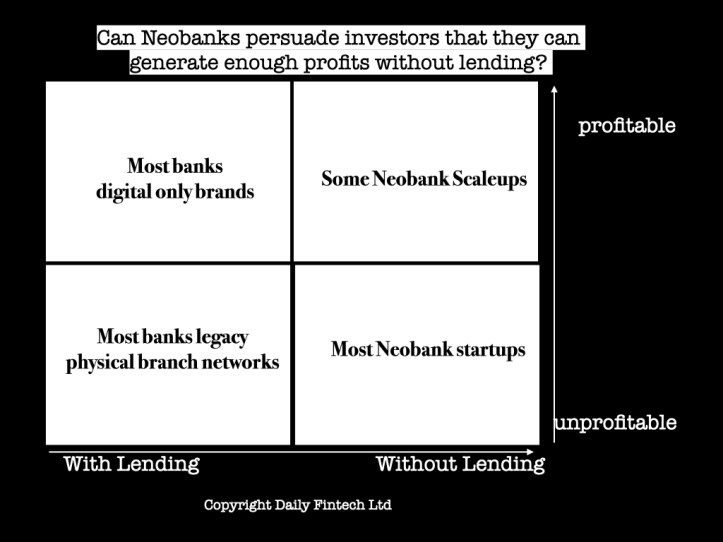

Fintech Macro Part 2. Neobank consolidation phase will create a few huge winners

During the Cambrian explosion phase, lots of Neobanks were funded. It was a period of high excitement, full of hopes and dreams. Cambrian explosion is usually followed by consolidation when: A. Lots of startups fail. For investors with a portfolio, this is difficult. For entrepreneurs, this is traumatic. B. A few startups make it to the…

Read more