Alt Lending week ending 2nd April 2021

Hedge funds leveraged bets risks stability say BofE official

Like London buses collapses seem to come along in pairs. First came supply chain finance house Greensill and immediately in its wake US hedge fund, Archegos, that looks suspiciously like a family office. Archegos rocked the markets with an asset fire sale deemed necessary to cover losses caused by debt financed bets that went wrong. Immediately those of us with a long memory went back to Long Term Capital Management a hedge fund which collapsed in the late 1990’s laid low by black swan events totally out of its control. LTCM used absolute return trading strategies together with high financial leverage and after a couple of successful years suddenly lost nearly $ 5 billion and threatened to take Wall Street with it. Its CEO John Merriwether was a veteran of Salomon Brothers bond trading and two other executives were Nobel Memorial Prize winners in Economic Sciences based on research for a new way to value derivatives. Hedge funds, family offices, whatever you call them, are not subject to very much regulation but banks lend to them and sometimes in huge amounts. LTCM was liquidated thanks to an agreement with no less than 14 banks all members of the great and good. Now we have a warning from the Old Lady of Threadneedle Street that events of this size could cause market mayhem. Two factors are common to both of the latest debacles. Leverage and lack of transparency. Credit Suisse looks like it is going to take a sizeable hit from both of them. Doesn’t look like we’ve learned much over the past 23 years.

Ben Marlow writing in the Daily Telegraph is perhaps focusing on a message nobody in the Fintech field actually wants to hear but he could be right. 2021 so far has been characterised by several high profile listings many of whom are claiming to be tech disruptors and attracting the premiums attached to such stocks. These include Moonpig, Trustpilot, Cazoo and now PensionBee. While the first three are not Fintechs PensionBee arguably is and has been tagged the Monzo of Pensions. As Ben points out the first three are just selling stuff on line and Monzo together with one of its other cohorts is nothing more than a current account provider with a jazzy front end app. PensionBee has potential but it has been around for 7 years already and there is still red ink on the P&L account. Investors should take note.

All awash with money and nowhere to go.

The point being made here is that the fundamentals of finance are not new, will never change and have all been tried before. The collapses discussed above are symptomatic of the easy money approach which had been in since 2008 and has accelerated during COVID. Whether we like it or not and we probably won’t we are going to find out the hard way which businesses are going to survive and those which aren’t once the government removes the support it currently supplies. It is not going to be pretty. To add to this proper bankers, people trained in understanding risk and how it is managed are now in short supply within the banking sector. If Carillon and Patiserrie Valerie showed in spades that neither bankers nor accountants understood number crunching then Greensill shows how anyone with a smooth patter can reinvent the wheel and the bankers will not find them out until the proverbial hits the fan.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

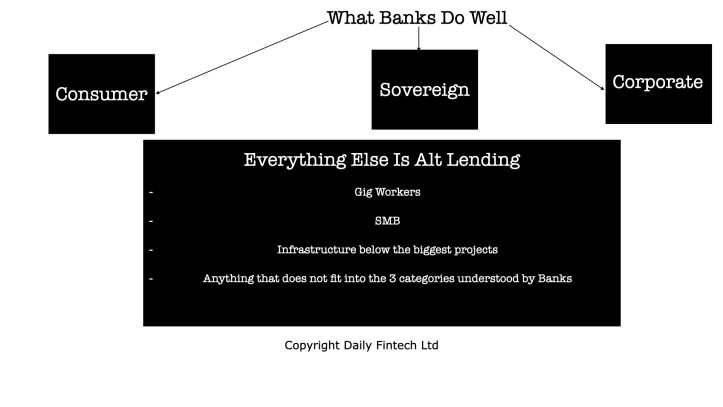

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.