Alt Lending Week Ended 9th April 2021

European Corporate Loan defaults double with worse to come?

Gloomy figures arrive courtesy of Standard and Poors Global ratings data the headline being that the default rate is 5.4% in the UK and Europe as of February this year more than double than those prevailing a year ago. Hardly surprising however given that some sectors have been particularly badly hit. Retail, leisure, entertainment etc. Governments however have been playing a stop gap role lending into a clearly deteriorating market. Emerging Fintechs are also going to have their applications assumptions tested. Certain asset classes are either looking very frothy retail property as debt collateral might be very problematic. In any case debt recovery expertise is going to be in short supply. Recognising what is fundamentally worth saving and what is not requires good technical skills and judgement. Unfortunately banks across the continent have deskilled their organisations just when they needed it most.

FCA Warns Gen Z on financial risks

Apparently the UK’s FCA are according to a recent survey concerned that some particularly young investors might not understand the risks they are taking on? This does not surprise me in the least. Events at Supply Chain finance house Greensill and its asset packaging partner Credit Suisse and the buyers of those assets have also demonstrated a less that detailed grasp of what they are getting in to and these guys are supposed to be market professionals. Heaven help us. But the fact that these youngsters appear to be heavily influenced by advice emanating from data management platforms is indeed worrying. It appears that the proliferation of investment apps. has some influence on this. In particular 40% of those surveyed did not recognise capital risk as a consideration! There have always been snake oil salesmen in the investment and finance business and many of them wouldn’t know a yield curve from a speed bump. It has ever been thus and probably always will be.

Green Activists target Barclays. What influence should Pressure groups have?

It looks like the green contingent want to get their pitchforks into Barclays for financing fossil fuels. Buying a few shares in a blue chip and then tabling a resolution for the AGM is nothing new. Apparently they are upset because Barclays are still financing fossil fuels. In today’s world protest groups tend to punch well above their weight and intellect so this cannot just be ignored. I would suggest however that before they start being physical they should investigate the targeted corporate that they hate so much. Most energy majors are in transitory mode and working hard to create economic models around green technologies. Most of us, including myself, are now supporters of green initiatives. The trick is to provide the energy at a cost which is affordable for everybody while at the same time not damaging the planet. Government involvement in the process is usually well intentioned but less than useful. The Uk’s initiatives are likely to end up harming a lot of the poorest people. Banks and Energy companies working together transparently is likely to be a win – win for everybody. Best not to knock it.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

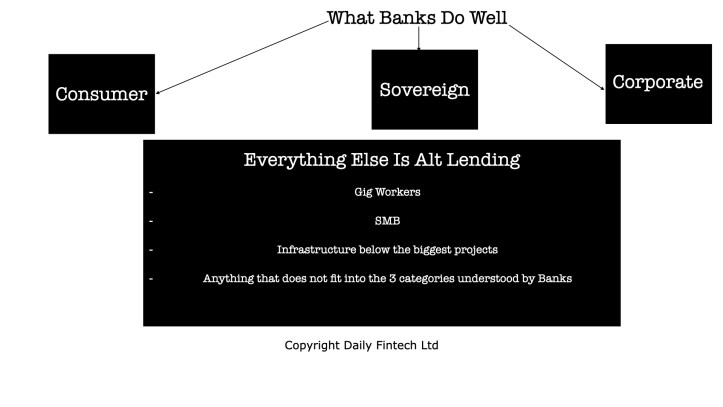

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.