Alt Lending week ended 3rd December 2021

Buy Now, Pay Later (BNPL) pioneer Klarna hit by customer Debt

The only problem with entering the consumer credit market is that the consumers do the consuming part rather well but it you are the lender you have to get them to cough up for what they have consumed. It’s called the risk business and if you don’t fully understand it then you are not likely to prosper. Klarna’s founder shareholders however have done extremely well and their business is valued by the market at a staggering $ 46 billion. Klarna has just posted a £ 255 million loss for the first 9 months of 2021 largely because of the fact that some of their rapidly growing clutch of users don’t mind the Buy now part of their offering but are having more difficulty in doing the pay later bit. On top of this Klarna now has a raft of competitors for its business and regulators and left wing politicians are asking whether this business model is good for consumers. Well if it makes the wheels of commerce go around more power to it. What must be recognised is that BNPL has been around for ever and ultimately it is an expensive and risky business which means it has to be priced properly. All the fancy apps in the world will not help a lender that doesn’t get its money back.

Taxpayer get £ 335million bill for British Business Banks lack of Due Diligence

The British Business Bank is owned by the UK state and its very laudable aim is to assist in the financing of small businesses. It is somewhat surprising therefore to find out that they failed to do the necessary due diligence on Lex Greensills “ supply chain finance “ operation. Mind you they are in good company. with Credit Suisse also not seeming to know what the Aussie was really up to. In any case as far as Britain is concerned it is just another few bob of the billions wasted annually by employees of the state from the NHS to the Home Office and back again. I have worked with state owned banks in the past and while their motives are never in question they can almost always be taken in by a sharp and plausible operator. What happens to people when they work for the government. Do they lose their marbles or just other peoples money?

Revout Banking app start up is good value at £ 24 billion says early investor

It was a toss up whether I wrote about this latest piece of hyperbole from someone who obviously has some skin in the game and needs to beef up his reputation or the bombed out business model of Amigo Loans which is struggling to survive. I very much doubt whether Revolut is worth £ 24 billion but if people are prepared to buy its new issues at that valuation then I am quite glad to be left out. Nevertheless the chief executive of VC firm Molten Ventures thinks it is good value based on the fact that it has real customers and real revenues and that it can increase its margins. Apparently that is aIl there is to it. I wish them all the best of luck as well as all the other fledglings that all look remarkably similar in terms of their offerings and technology. I remember once having a letter from Goldman Sachs telling me that the company I was working for was worth 1,000 time current revenues. I didn’t believe them and I was right.

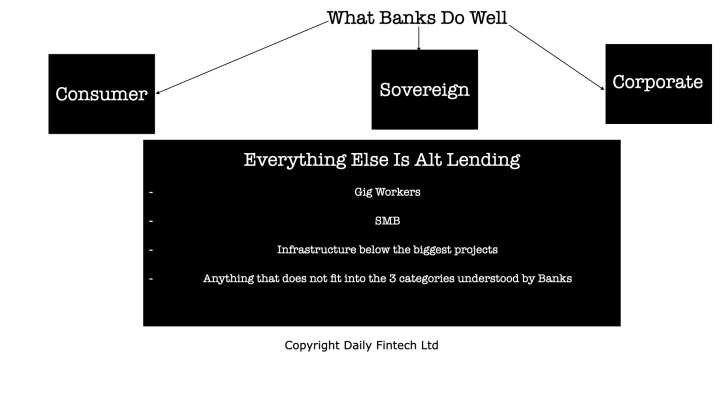

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.