This Week in Fintech ending 3rd December 2021

Yes, we are in the last month of 2021. How are you doing on your New Year’s Resolutions?

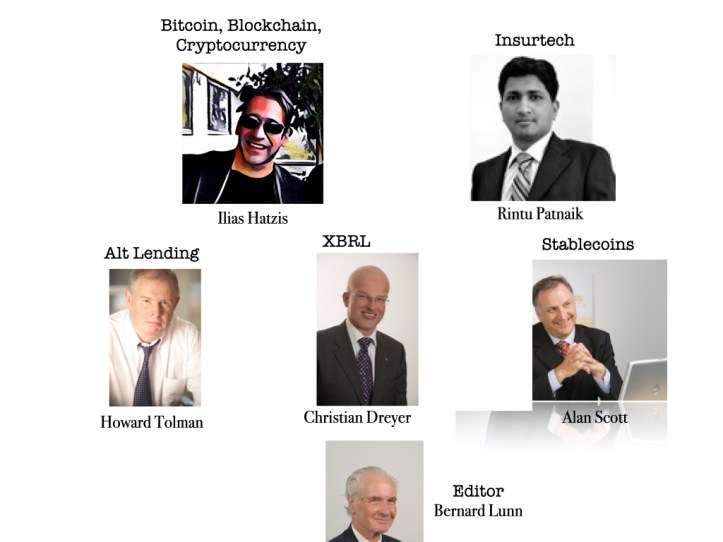

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Will crypto destabilize countries undermine the role of the US dollar?

Recently in the news, Hillary Clinton, the former Democratic presidential candidate in the 2016 elections, warned that cryptocurrencies could destabilize countries and undermine the role of the US dollar as a reserve currency. Clinton said Russia and China are manipulating cryptos and the Biden Administration needs to regulate the cryptocurrency market. As bitcoin and other cryptocurrencies have now gone mainstream, financial regulators in Washington have started to express increasing concerns about bitcoin and other cryptocurrencies. Institutional investment managers like JPMorgan and Blackrock, which initially opposed bitcoin, are now helping their clients invest in cryptocurrencies. El Salvador in early September declared the cryptocurrency to be legal tender, allowing it to be used for payments. Last month the first bitcoin ETF was introduced on the New York Stock Exchange, allowing U.S. investors to speculate on Bitcoin prices without actually owning it. But so far US regulators have been more focused on regulating cryptocurrencies in the context of capital controls, securities fraud, and tax evasion. The US knows how privileged it is to have its currency function as a global reserve. As more powerful institutions and other countries adopt in cryptocurrencies, the US government will increasingly be pressured to take a stance on the new asset class. If bitcoin and other cryptocurrencies are here to stay, what will the future look like? The answer is complicated.

Editor note: The geopolitics of Bitcoin as US faces the end of global reserve currency is very interesting.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Can Neobanks persuade investors that they can generate enough profits without lending?

Neobanks (regulated digital only) are hot right now with 5 already in the Fintech 50 Index, many more lining up to IPO and top tier investors (including Warren Buffet in Nubank) going all in on private equities. However with the public equity market demanding profits again and with many Neobanks getting revenue without lending, the question we address today is whether Neobanks can persuade investors that they can generate enough profits without lending.

Editor note: If Fintech is in a bubble, thanks ironically to central bank money printing, the rush to finance Neobanks maybe to blame.

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: The Climate Change Conundrum Part 2: Insurtechs Unravel Solutions

Part 1 discussed ways in which carriers are reorienting themselves with the long-term view on climate change. In this final Part 2, read about the differentiated approaches that leading insurtechs are adopting.

John Neal, CEO of Lloyds market opines, “Climate is the “ultimate systemic risk” and represents “the biggest single opportunity the insurance industry has ever seen,”. An extreme freeze in the U.K. during 2018 led to payouts for burst pipes totaling £194 million over three months. The same year, an extreme heatwave affected 10,000 homes in the U.K. with claim damages exceeding £64 million.

Editor note: Rintu shines a light on the role of “climate intelligence” ventures in solving a problem that impacts billions of humans on this earth.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

To continue receiving ‘This Week in Fintech’, the weekly recap of our articles, you will need to fill this form to give us consent to send this to you. Please note that Daily Fintech requires your organizational email address (e.g. corporate, educational or government) and your LinkedIn URL. This information is required for subscribers who want ‘This Week in Fintech’ for free. If you prefer to not provide this information, you can still receive all our content by becoming a paying member.