A plan to fund the global green transition already exists

Climate change updates

Sign up to myFT Daily Digest to be the first to know about Climate change news.

The writer is assistant professor of history at Cornell University

On 28 September 1941, two businessmen on a mission arrived in Moscow. Lord Beaverbrook, the Canadian-British owner of the Daily Express, was minister of supply in Winston Churchill’s war cabinet. With him was W Averell Harriman, the railroad heir and banker who was Franklin Roosevelt’s envoy to Europe. What prompted these two capitalists to visit the centre of global communism was Hitler’s invasion of the Soviet Union. Fascist forces stood only 200 miles from the Kremlin.

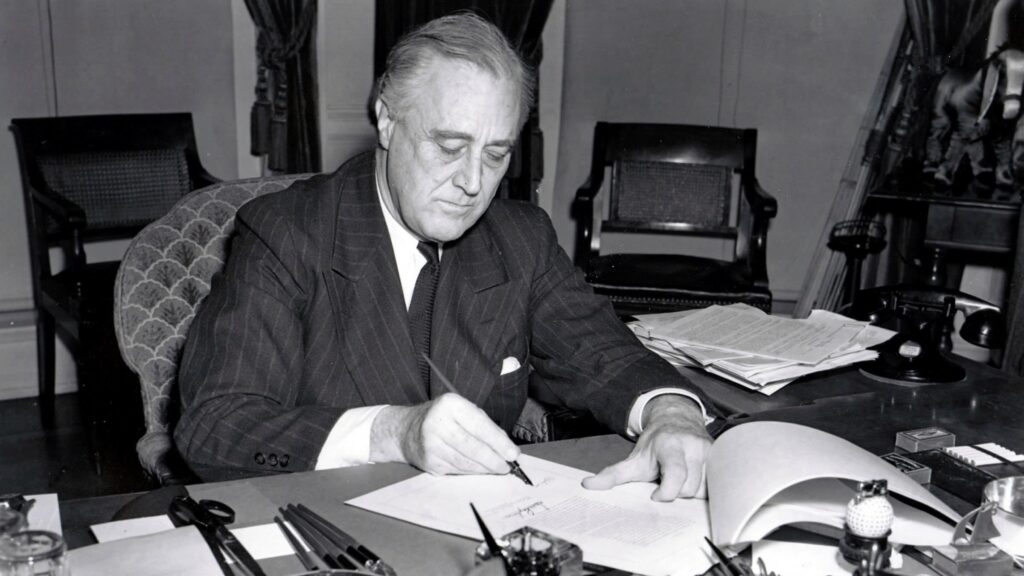

The carrot that Beaverbrook and Harriman had brought was the Lend-Lease Act, written into law by Franklin Roosevelt earlier that year. In the struggle against Axis aggression, the bill enabled the Allied provision of supplies against deferred payment. On October 1, the delegates signed the Moscow Protocol with Joseph Stalin’s foreign minister. This unlocked massive Lend-Lease aid flows that delivered tens of thousands of aircraft, trucks, tanks and vast quantities of machinery, munition, food, fuel and clothing to anti-fascist armies worldwide. It sealed Allied victory in the war.

Today, the climate crisis is arguably an even greater threat to humanity than fascist aggression was in the 1940s. The 80th anniversary of the Moscow Protocol should prompt us to reflect and think: would it be possible to imagine a green Lend-Lease programme to fight climate change? Such a policy could adapt the best elements of the 1940s formula to 21st-century conditions. Three particular aspects stand out: diplomatic flexibility, public-private co-operation and global distribution.

Lend-Lease was a victory of pragmatism over ideology. The programme, started by the US but administered jointly with Britain and other Allies, was open to any state, regardless of its political orientation. Half of the world’s sovereign states signed up for it. By 1945, this alliance formed the initial membership of the United Nations. Yet only half of the 36 countries that received aid were democracies. Aid went not just to Stalin but to other authoritarians including Chiang Kai-shek, Getúlio Vargas and Ibn Saud. Lend-Lease funding was not just indiscriminate, but large. The programme expended near $50bn — one out of every six dollars spent by Washington during the war. This is nearly four times as much as the $13bn of the better-known Marshall Plan.

Lend-Lease’s second strength was its reliance on public investment to mobilise private resources. US government spending equal to 1.5 per cent of gross domestic product kickstarted a wave of private investment. A recent G7 report estimates combined public and private investment worldwide needs to rise by 2 per cent each year to meet climate targets. But today there are more rich countries, that can borrow at much lower rates, than in the 1940s.

Third, Lend-Lease efficiently used the global division of labour of its time. It directed the most advanced economies, the US and Britain, to produce equipment and supplies for the front lines, from the Eastern Front to north Africa, India and China. A green Lend-Lease programme could likewise exploit regional economic specialisation and investment needs. European and US firms dominate innovation in green technology, and western investors own most of the capital to fund the energy transition. But the productive effort is best focused in East Asia, the region with the high-tech manufacturing capacity to produce low-carbon technologies. Meanwhile, it is the developing world that most urgently needs large-scale investment in renewable energy grids, more resilient infrastructure and better-protected food provision.

As world leaders prepare for November’s COP26 in Glasgow, ominous talk of a “new cold war” should not distract from the need to accelerate the global energy transition, regardless of ideological differences. Lend-Lease remains one of the most powerful examples of how realpolitik and public-private finance can drive ambitious internationalism.