Tellurian chair: Europe’s gas crunch must be a wake-up call to America

Hello again from Energy Source.

After last year’s trauma, US shale production is rising again — and big growth is expected in 2022, Justin Jacobs reports this morning. It’s not a return to the rampant production surges of the boom years, but it’s more than even some shale executives themselves expected.

Across the Atlantic, the big energy story remains the natural gas crunch. The US energy secretary Jennifer Granholm has now weighed in, saying the US would “stand up” to manipulation of Europe’s energy market. But how? As we wrote this week, the US has plenty of spot natural gas it can export to Europe — but Asian buyers are willing to pay more for the supplies.

And UK power generator Drax told us it could postpone next year’s planned closure of its two remaining coal-fired units if called upon by the British government.

The International Energy Agency, meanwhile, has suggested Russia could supply more natural gas. Russia argues that if Europe wants more of its natural gas it should have approved a huge new supply pipeline to Germany more quickly.

One consequence of the mess is a CO2 shortage — an outcome of the closure of fertiliser plants because of soaring gas costs. The shortage is now ripping through the food industry, which uses carbon dioxide in everything from making drinks fizz to preparing animals for slaughter.

The bigger problem might be what it all means for the EU’s green agenda. As our colleagues at Europe Express wrote:

“When the commission proposed its ‘Fit for 55’ climate strategy in July, the continent was suffering from flash floods in Belgium and Germany and devastating forest fires in Greece. Today’s price crisis has swung the debate back on to the costs, rather than benefits, of the climate transition for politicians who are scrambling to protect households.”

Cambridge professor Helen Thomas argues in a must-read FT op-ed that there are no solutions to this crisis, only “politically nightmarish choices around hard realities that [Russian President Vladimir] Putin can have Gazprom, Russia’s state-backed monopoly gas exporter, make still worse”.

Can it happen in the US? Our main note today is an interview with Charif Souki, the liquefied natural gas tycoon, who tore into American energy policy, warning that without careful supply management, the country risked facing “exactly what happened in Europe”.

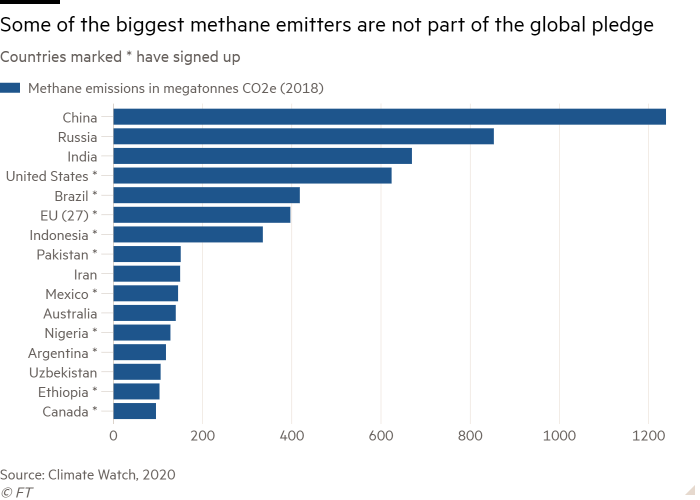

Also in today’s newsletter: Data Drill shows how much more diplomatic toil is needed to secure a genuinely global deal to cut methane emissions.

Thanks for reading.

This article is an on-site version of our Energy Source newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday and Thursday

What the US can learn from Europe’s gas shortage

The US is barrelling towards the sort of energy supply crisis that is gripping Europe unless the Biden administration comes up with a more coherent energy policy, warns Charif Souki, the executive chair of liquefied natural gas developer Tellurian.

“You can see if you don’t have a very careful energy policy, what happens is exactly what happened in Europe. You go with misguided priorities and then all of a sudden you hit a wall because you don’t have supply,” Souki told us.

Natural gas and electricity prices have spiked in the UK and across Europe to all-time highs. The surging prices threaten to undermine the nascent economic recovery as the region scrambles to secure supplies amid low inventory levels and rising demand. Some are warning the lights could start to go out if there is an especially cold winter and demand surges.

Souki, who took advantage of soaring shale gas supply to pioneer the Lower 48’s LNG export industry, said any such crisis would play out differently in the US because the country is a major energy producer. However, risks are especially acute for parts of the country that remain isolated from supply because it has become too difficult to build new pipelines, he argued.

“Prices are high in California today . . . and we’re starting to put gas-fired power plants back in California. But we don’t have infrastructure to take the gas to California,” Souki said.

The Biden administration should be doing more to make sure natural gas supply can reach customers, said Souki, especially in places like California and the north-east US.

However, President Biden is pushing hard to wean the US off fossil fuels such as natural gas and coal, and wants to see a rapid build out of wind and solar power, underpinned by batteries, with a target of rendering the power grid carbon-free by 2035.

But the threat of supply disruptions and high prices could undermine confidence in the existing grid and see the energy system splinter, according to Souki.

“Because the grid is so dysfunctional in states with such different political systems, such as California and Texas, you’re going to have more interruption in services,” he said.

“People will have to decide whether they’re going to accept that the grid will be there for them or whether they’re going to take things into their own hands. It’s not that expensive to put a generator in your home.”

Souki is hoping to take advantage of the emerging shortages in global gas supply by pushing ahead with a plan to build a new LNG-export plant on the Gulf coast. He expects to approve that project by the end of March next year.

But he said he hoped the European gas crisis would be a wake-up call for the administration.

“Give President Biden some time. I’m hoping that when he finishes with all the rest, he’s going to have time to focus on energy policy and to start looking at it in a holistic sense. You have to have an energy policy.” (Justin Jacobs)

Data Drill

As the US and EU lobby top methane emitters to join a new global pledge to slash emissions, just how effective the initiative will be remains unclear.

The Global Methane Pledge aims to reduce emissions by 30 per cent in 10 years. But as it stands the agreement is missing key signatories including China and Russia, the two largest polluters making up a quarter of global methane emissions. The pledge also lists no country-level targets to cut methane.

Reducing methane emissions has been hailed by the UN as one of the “most cost-effective strategies” to combat climate change. The greenhouse gas is 80 times more powerful than carbon dioxide and is responsible for at least a quarter of global temperature rise, according to the latest IPCC report.

More than half of methane emissions come from three sectors: fossil fuels, waste and agriculture. The EU has already made efforts to tackle emissions in these areas. In the US, Congress has repealed Trump-era rollbacks on methane pollution standards in oil and gas and the Biden administration intends to crack down further. (Amanda Chu)

Power Points

-

China pledges to stop building coal plants overseas but will continue to support projects at home.

-

UK’s first green bond sale draws record demand.

-

One of Scotland’s largest industrial sites is turning to hydrogen to slash emissions.

-

Combating climate change isn’t glamorous — it requires a thousand tiny boring steps.

-

The CEOs who called for climate action are now working to block it. (Rolling Stone)

Energy Source is a twice-weekly energy newsletter from the Financial Times. It is written and edited by Derek Brower, Myles McCormick, Justin Jacobs and Emily Goldberg.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here