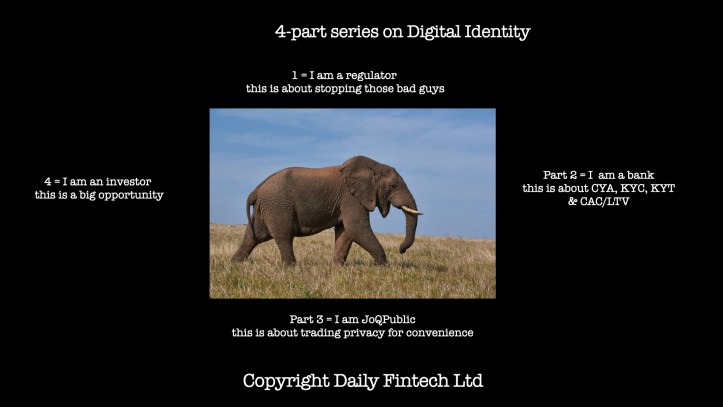

4-part series on Digital Identity. Part 2 = The bank says this is about CYA, KYC, KYT and CAC/LTV.

Starting with the rude stuff, CYA = Cover Your Ass. Clean part of headline: KYC = Know Your Customer, KYT = Know Your Transaction, CAC = Customer Acquisition Cost, LTV = Life Time Value. Read on, all will be revealed.

For banks this is CYA because they need enough legal cover to minimise fines when they get caught. So, the identity verification compliance solutions have to be good enough to offer some protection when something goes wrong as in “we used one of the best identity verification compliance solutions” in the market.”

“Good enough” includes technical functionality that is state of the art, that cover all the bases, which means KYC and KYT. KYC (Know Your Customer) is the core of identity verification. This person claims to be Josephine Bloggs, but is she really Josephine Bloggs? That might sound conceptually simple, but it is actually a big complex technical problem. However KYC alone is not enough. Banks also need KYT (Know Your Transaction) and KYC and KYT need to be integrated. Occasionally the person who you thought was Josephine Bloggs is actually a criminal. But if Josephine Bloggs usually does transactions below $10K and now wants to do a transaction over $100K, alarm bells should ring.

Building a totally secure identity verification solution, with perfect KYC and KYT is possible – as long as you don’t care about having customers or revenue. This brings us onto CAC/LTV.

Banks are from Venus and Fintechs are from Mars, but both understand CAC/LTV (Customer Acquisition Cost/Life Time Value).

Both are complex in their own right, but it is the interaction between the two that is so often confusing or difficult. The business of banking and Fintech can be summed up in this formula.The story of banking in the 20th century can be summed up as high Life Time Value. We are statistically more likely to get divorced than change banks. Historically there was little point in changing banks, because the difference between banks was marginal. The Fintech disruption changes that. Now customers have more real choice and regulation is seeking to protect consumers from lock-in strategies that make it hard for them to switch and Fintech sell on low friction which applies to both on-boarding and off-boarding customers.

With Life Time Value a changing reality, reducing CAC is key. An identity verification compliance solution that offers both good KYC/KYT and a low CAC will do very well.

In the end, customer traction (ie low CAC) is what matters. Customer traction is a good proxy for technical competence and gets the attention of investors and media and traction with investors and media is enough to get a CYA tick in the box for enterprise customers/banks. Customers want to see a vendor make the normal lists – that signals enough CYA.

So I was keen to talk to Ricardo Amper, Founder & CEO of Incode. Incode does NOT appear in any of the normal lists of the top identity verification vendors, yet I could see they were getting traction with investors and customers. So I thought there must be an interesting story there.

What Ricardo claimed was that they have raised the bar by eliminating the need for humans in the process. According to Ricardo, the currently top ranked identity verification vendors use humans in contact centres to complete identity verification. If so, banks can reduce costs and increase accuracy (fewer false positives). More importantly banks can reduce CAC. Ricardo claimed that 94% of people get validated automatically, which translates as more customers getting through this last stage of the customer acquisition funnel. Ricardo told me that conversion is between 40-60% is more normal. Lower conversion = losing customers = high CAC.

The key to CAC is the customer of course, people like us, the customers of the enterprises that buy identity verification solutions. That is our focus in Part 3 = next week entitled: JoQPublic says this is about the trade-off between privacy & convenience.

Click here for the first post in this 4-parter (with an index).

Some subjects are too complex for our short attention spans. For those subjects we do 4 posts one week apart, each one short enough not to lose your attention but in aggregate doing justice to the complexity of the subject. Stay tuned by subscribing.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.

Aadhaar compliance Consumer Banking digital identity identity verification Regtech