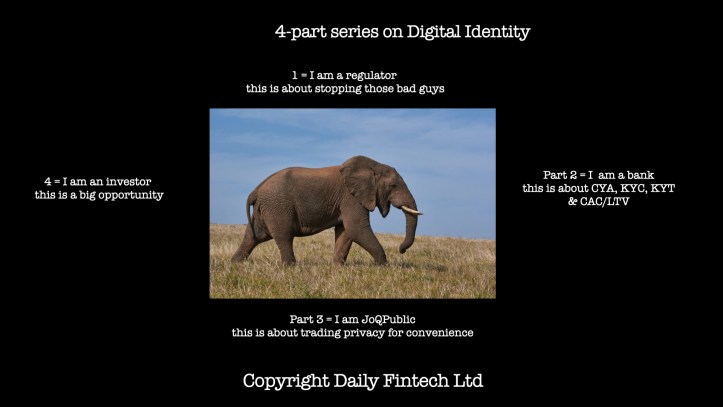

4-part series on Digital Identity. Part 1 = regulators say “stop those bad guys”

Are you really sure I am not a dog? Maybe I am a really smart dog with an AI implant pretending to be a human. Disclosure, Daily Fintech is written by a stealth mode AI venture as a proof of concept.

Seriously folks, you cannot know my Identity. To read this post you don’t care. If you are going to send me money, you do care. You do not want to send money to my dog.

Identity is like the elephant that 4 blind people describe differently depending on which part they are feeling:

- The regulator says this is all about stopping the bad guys. That is our focus in Part 1 = today.

Regulators care about 4 things:

- Stopping enough of the bad guys to keep their job. Regulators cannot hope to anticipate the ingenuity of private sector crooks, but their employers can expect them to stop the last bad result from repeating.

- Government issued identity artifacts should still drive the process. Government issued identity artifacts (such driver’s license, passport or social security card) have traditionally been analog with some recent machine readable digital add-ons. India sees digital identity as the on ramp to financial inclusion, so they are leapfrogging the West via Aadhaar – another example of “first the Rest then the West” – by enrolling people with 13 biometrics (10 fingers, 2 iris scans and a photo) and then issuing a unique 12-digit random identifier (11 random numbers and one check digit).Ardhaar is far more secure than something like a Social Security Number in America which is easily hacked by identity thieves. Ardhaar makes authentication very easy in India. Ironically India is also where the current generation of Identity Verification solutions use contact centres staffed with humans – as we describe in next week’s post entitled the bank says this is about CYA, KYC, KYT and CAC/LTV.

- A clear set of rules for the companies they regulate. These rules should be technically feasible with solutions using current technology. For banks, meeting regulator demands is an existential issue as we describe in next week’s post entitled the bank says this is about CYA, KYC, KYT and CAC/LTV.

- Protecting consumer privacy. Regulators have to think about what consumers might worry about in the future; today consumers tend to trade away their privacy for convenience. Banks know that convenience drives revenue so they are keen to get the trade off right between privacy, security and convenience as we describe in next week’s post entitled the bank says this is about CYA, KYC, KYT and CAC/LTV.

Some subjects are too complex for our short attention spans. For those subjects we do 4 posts one week apart, each one short enough not to lose your attention but in aggregate doing justice to the complexity of the subject. Stay tuned by subscribing.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.

Aadhaar compliance Consumer Banking digital identity identity verification Regtech