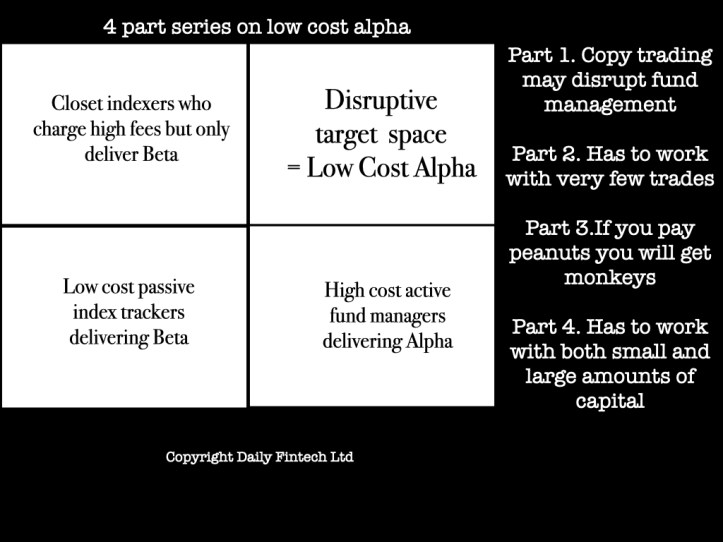

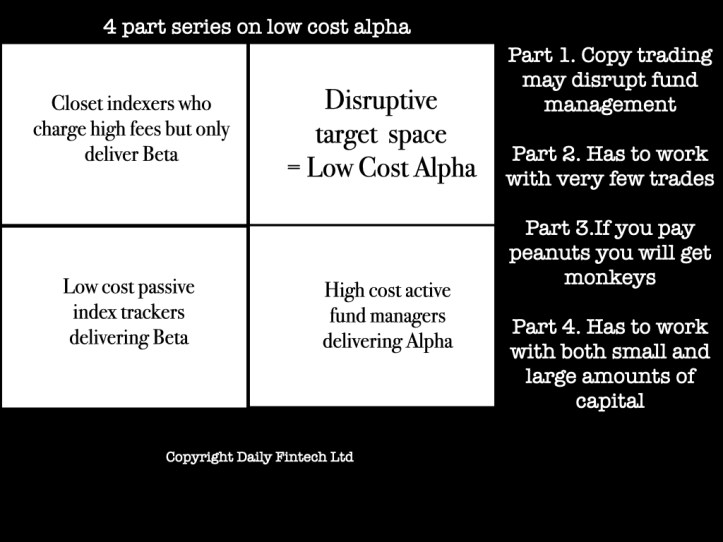

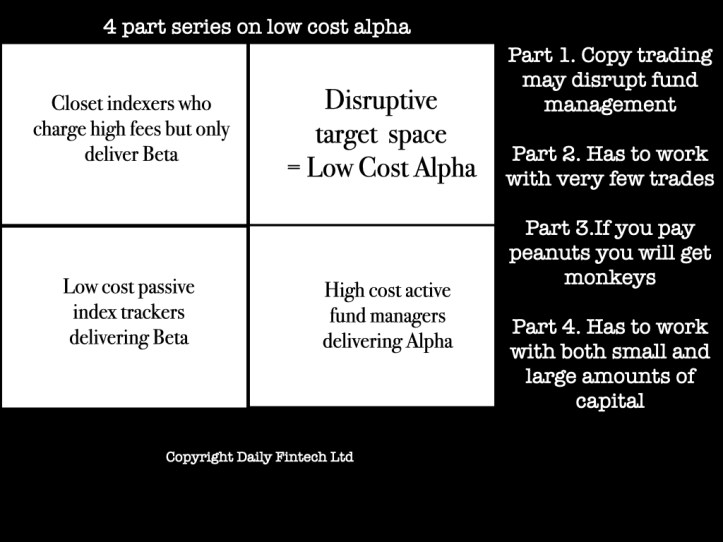

Part 4 Has to work with both small & large amounts of capital

The law of large numbers is brutal in investing aka pity rich Mr Buffet and Mr Munger. Think about what it takes to go 10x from: 10k to 100k 100k to 1m 1m to 10m 10m to 100m 100m to 1b 1b to 10b 10b to 100b All numbers assumed in US$ but actually the…

Read more