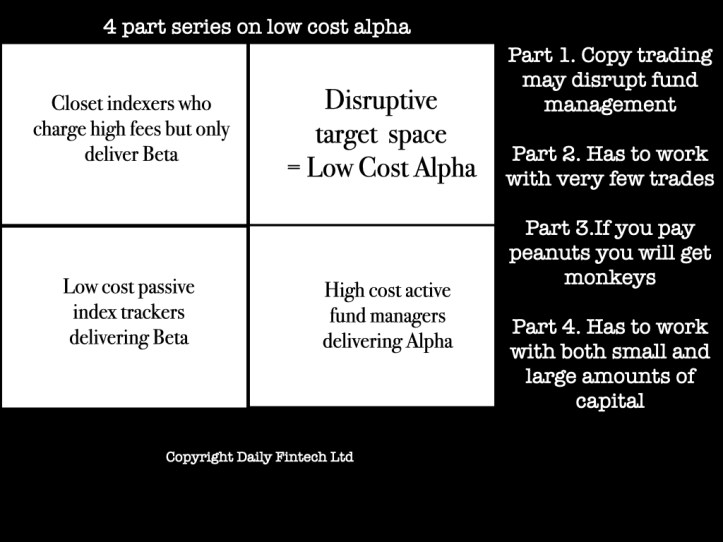

Part 4 Has to work with both small & large amounts of capital

The law of large numbers is brutal in investing aka pity rich Mr Buffet and Mr Munger.

Think about what it takes to go 10x from:

- 10k to 100k

- 100k to 1m

- 1m to 10m

- 10m to 100m

- 100m to 1b

- 1b to 10b

- 10b to 100b

All numbers assumed in US$ but actually the principle and math is the same in any currency.

Going 10x from 10k to 100k is much, much easier than going from 10bn to 100bn for two reasons:

1. Risk aversion increases as you get more capital. This is not logical. If you have 10k to invest and want to get to 100k and you are willing to risk all the 10k, the risk is exactly the same as if you have 10b to invest and want to get to 100b and you are willing to risk all the 10b. All that changes in reality is one letter but emotionally everything changes. This is a lesson that all poker players have to learn – play the cards and the people not the amount of the bet.

2. You have a lot more assets to invest in. You obviously cannot deploy 10b in a company with a market cap of 2b. If you are investing 10k, almost an asset is investable.

10x sounds good but how long does it take to get 10x? If it takes 100 years your annual return is not that good. If you get 10x in 5 years (like many VC promise) the annual return (IRR in fund speak) is 58.49%.

50%+ a year is very, very good and very, very unusual, if it it is net of inflation. To get that kind of return you need:

A. To be both contrarian and right. Sometimes that is as easy as being greedy when others are fearful. For example in 2002, after the Dot Com crash all you needed was a belief that there was still some value in software. Being both contrarian and right is harder when the market is bullish as it is today – hard but not impossible.

B. Patient but not delusional. If you trade a lot you will make brokers rich and because computers can trade faster than you, you probably won’t make yourself rich; be patient. Nor is buy and hold ie never sell good in a world with a lot of disruptive innovation. Sometimes it is good to throw in your hand and accept that you have been contrarian and wrong; do not be delusional. Choose your time horizon and check in regularly. Companies in the the US stock market report quarterly and that is a good time to check in, even if you choose 1 year as your time horizon.

10% of your capital that increases 10x is meaningful. It does not matter whether you are investing 10k or 10m or 10b, if your total assets are 100k or 100m or 100b. You can take a high risk/return approach with 10% of your portfolio. Let’s say your portfolio is 100k; if you lose 10k it is bad but not catastrophic and a 10x return doubles your portfolio assuming the 90% stays the same.

Mr Buffet and Mr Munger are of course OK. They are in the 1% of the 1%. Up to $1m you are “retail” derided as muppets; this is the world of rapacious brokers and mission-driven impact ventures that care about genuine democratisation of markets. Above $1m you enter the market segments known as mass affluent and from HNWI to UHNWI that a lot of wealth managers target.

Some subjects are too complex for our short attention spans, so we do 4 posts one week apart, each one short enough not to lose your attention but in aggregate doing justice to the complexity of the subject. Stay tuned by subscribing.

Some may not be published yet.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.