API-led Platform businesses rising – Swiss Re’s iptiQ in focus

Digital ecosystems, orchestrated by powerful platform businesses and crisscrossing traditional industry sectors, are estimated to top 30% of global economic activity by 2025. While Amazon, Google, Alibaba, Tencent are early pioneers, others are shaping up across strata, in B2B as well as B2C. They thrive by efficiently matching supply with demand while solving deep entrenched problems, such as protection gaps.

Leveraging real-time insights on user preferences, embedded finance – a step-up from reselling services – uncovers revenue opportunities at lower incremental costs. Similarly, embedded insurance enables third-party providers to seamlessly integrate solutions into customer experiences via insurance functionality abstracted as technology hooks .

Embedded insurance is enabling car-share services to offer mobility insurance instantaneously. Some of this happened already, but it was clunky. For insurers who ‘white label’ their products to third parties, timeframes were months to conclude deals, and years to returns. The world is a-changing for financial services and insurance, which might potentially fade into the background of customer offerings.

The embedded model is suited for commodity lines with high levels of automated underwriting. For consumers buying products, providers take all information from purchase flows to seamlessly offer bindable quotes. Underpinning technologies are: a) Third-party APIs and b) SaaS architecture.

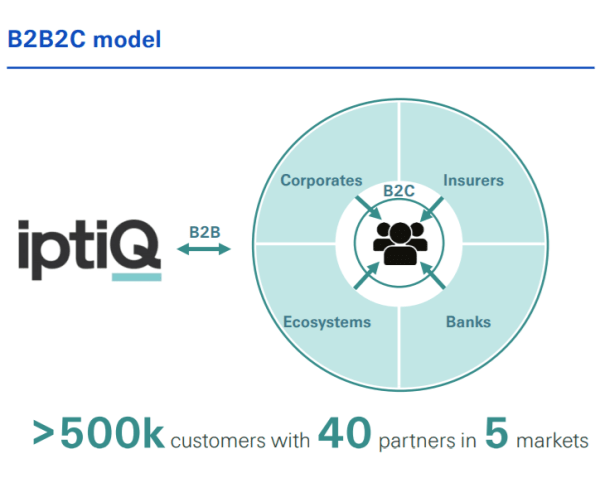

Established in 2016 as a global B2B2C digital venture focused on insurance distributors, Swiss Re’s iptiQ is pioneering embedded models among specialist insurtechs, driving substantial implementation cost savings and improved underwriting. It is expeditious for partners eyeing an opening into crowded markets and unlocks revenue streams. iptiQ boasts of an insurtech platform with an underlying carrier, being highly configurable with 140 L&H products pre-built. Established distributors are up and running within 60 days.

iptiQ crossed 500,000 customers with 40 partners in 5 markets. Its growth trajectory pegs its market-implied valuation at $2 billion. Its strategic partnership model enlists: a) Existing insurers launching new products in new markets or channels b) Affinity groups with large customer bases that cross-sell financial products. c) Experienced startups with unique propositions to cover un-insureds.

iptiQ and IKEA launched HEMSÄKER – home insurance that can be purchased on IKEA’s website. With easy-to-understand language, cover can be purchased in minutes. The partners tested extensively the digital customer journey that’s easy to navigate and uses terms to let customers know exactly what they are covered for.

Another partner is ImmoScout24, Germany’s leading real estate platform, which launched loss of rent insurance integrated into its digital ecosystem. In few clicks, private landlords protect themselves against financial uncertainties from tenancy agreements. The insurance covers complete or partial loss of up to six months’ rent, in case of defaults. While ImmoScout24 acts as a registered agent, all insurance-related aspects are covered by iptiQ, from the user journey to policy issuance to claim settlement and payment.

Medibank is a leading Australian private health insurer, providing health cover needs of 3.7 million customers. It has created a solution with iptiQ that offers benefits to the customer by reducing average time to buy, improving online conversion rates more than 100%. Sales increase is achieved with much lower CAC and best in market lapse rates.

Customers choose from 4 health statements that best describe them and receive a quote immediately, after sharing basic personal details. At the quote screen, customers adjust cover and optionally provide height and weight inputs, which allows iptiQ to generate a BMI score and offer lower premiums. This new customer experience went to market in three months by using API gateways from Medibank’s digital front end.

Growing from 12 to 40 partners over 3 years, iptiQ has consistent, impressive results to show. In-force policies increased significantly y-o-y with increases in L&H and P&C. Through its partner ecosystem and API-led engine, iptiQ helps individual firms achieve much more than they individually can, in effect becoming greater than the sum of its parts.

You get 3 free articles on Daily Fintech. After that you will need to become a member for just US$143 a year (= $0.39 per day) and get all our fresh content and our archives and participate in our forum.