Alt lending week ending 4th Feb 2022

Bankers’ Fury as Credit Suisse claws back bonuses

Poor old Credit Suisse they never seem far from controversy and now there is a row over bonus payments. Specifically some of the non front office staff will have bonus clawback provisions built into their employment contracts. What I found hard to fathom was that the bank felt that this would affect about one fifth of their fifty thousand staff? I don’t see how this could possibly be correct. More to the point how can a major bank like Credit Suisse have got itself into the position where 80% of its staff qualify for performance bonuses. Who runs the back office, runs HR or administrative functions. One employee pontificated that the bank was going down the Loo. Who cleans those? Working in a bank for most run of the mill clerical staff means that they don’t go anywhere near the risk and deal making side of the organisation but somehow or other the bonus culture has taken hold not just at Credit Suisse but everywhere else in the overpaid banking world and that includes IT. Why do bank employees working in IT earn more than those involved in other industries? In Credit Suisse’s case why didn’t the deal makers know what they were doing?

Three reasons why big tech has failed to make an impact on the finance sector

Matthew Lynn focuses, amongst other things, on why projects like Meta’s (or Facebook’s) Libra currency have spectacularly failed to make any dent on the big beasts? It certainly wasn’t for lack of money or hype. This piece gets to the nitty gritty of why it is so difficult for tech offerings to gain a foothold in the mainstream of finance and deploying assets through lending is a large part of that franchise. Firstly regulation, some of it necessary but most of it not. Regulation is fly in the ointment of innovation in general. The less we have of it the better. Second, the importance of brands and trust. Putting someone in charge of your money is a big decision and it is notoriously difficult to get people to change their main banking relationship. These things are very sticky. Lastly what is really being offered? He points out that many offerings don’t provide anything he couldn’t do with a mastercard. Good point. The truth is that tech offerings currently are on the fringes. There has been some traction in payment systems, largely based on cost and other like Buy Now pay later which punters don’t necessarily see as credit and which can turn nasty if the going gets tough. Is there anything really new on the horizon?

Downing Street picking Tech Winners?

Quite a widely published story. Apparently Boris Johnson would like to see Swedish Buy Now Pay Later company Klarna list in London. I suppose that the sheer valuation of the company is eye catching, if not eye watering, considering what it does, but I’m not sure that politicians should get involved in this kind of stuff. Klarna is a phenomenon of our times. It allows people to buy things in instalments. Nothing new in that: but it uses application technology in order to connect to the point of sale and is therefore firmly connected to tech hype. My concern is that politicians should try and do their day job properly and leave markets to themselves. The FCA is looking closely at regulating Klarna and the rest of the sector. This is a relatively new company now finding out that lending money in the retail sector sometimes means credit losses. The government has egg on its face from Bounce Back Loans. Lessons to be learned?

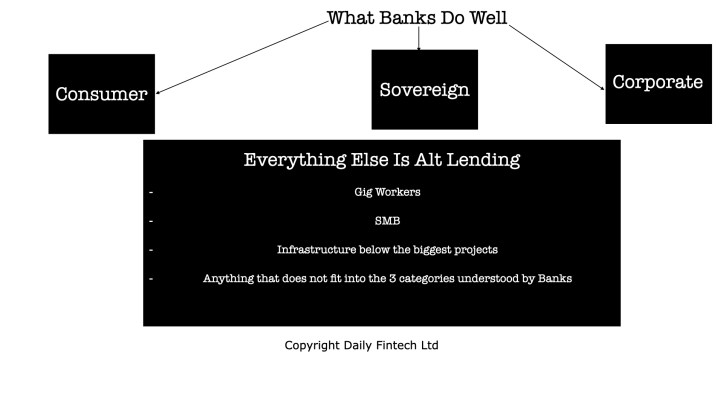

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.