Alt Lending week ending 17th December 2021

Zopa pulls out of peer to peer lending. Lessons everyone in lending should learn

Great article by Matthew Lynn in the Sunday Telegraph business section. While this is ostensibly about the withdrawal of Zopa from the peer-to peer funding market, it contains wider truths about lending in general. Matthew has been around the block a few times and gets it spot on. He makes three keynote points. Firstly there is nothing ever really new in finance. Secondly that middlemen, banks, brokers do have the capability of adding value and lastly, perhaps most importantly for this publication is that peer-to-peer schemes don’t work. He fleshes this out at some length but the key is that lending to people you don’t know is a risky business and requires plenty of real life expertise preferably learned at the school of hard knocks. Whatever technical experts tell you this is unlikely to help anyone make a good credit decision. Some recent scandals such as Carillon and Patiserrie Valerie mean that even audited financial statements need close scrutiny and an ability to understand how the numbers were arrived at. For investors though the main issue is surely that there is nothing truly new in finance and the lofty valuations given to challenger institutions, “hyped up revolutionaries” Matthew calls them, frequently end up on the scrap heap.

“Pay Later” needs regulation now.

Telegraph’s City Editor is calling on the FCA to regulate the fast growing Buy Now Pay later(BNPL) market led by Swedish App based lender Klarna which has recently started TV advertising to publish its offering. I wrote recently that Klarna has a problem with non payment from some of its clients. Hardly surprising really when something looks too good to be true it probably is. Nevertheless a lot of companies are looking at ways to boost sales in the COVID days and BNPL is one way of making people spend money that they don’t currently have. If you miss a payment however the results can be really painful with high penalty fees and debt collectors knocking on your door. I don’t suppose they tell you that at the time you buy that new coat? This problem is quite a big one according to the Wollard review saying some 5 million people have borrowed money in this way since the beginning of the pandemic and 10% of them are in arrears. It’ll probably be worse

NatWest fined £ 265m over money laundering racket

Although not strictly about lending I had to laugh when I saw this one. The Government controlled bank has been fined over money laundering regulations which were apparently breached between 2012-18. This just demonstrates everything that is wrong with regulatory regimes more or less anywhere. This was no complex or devious operation. The client in question was Fowler Oldfield a Bradford based gold dealership closed down by the police suspecting it as a front for illegal drugs. One of the clues which the bank did not notice was the depositing of large amounts of cash in one of their branches where cash was packed into bin liners which split under the strain and could not be put in the branch’s safe as there was too much of it. Surely some kind of a clue? I once was part owner of a quite legal cheque cashing operation and had to answer questions on money laundering suspicions. I had to point out that the cash we dispensed was all traceable as it had been withdrawn from the bank and delivered by Securicor. I pointed out that money laundering was usually turning cash into legitimate instruments, not the other way round. It took time for this to sink in. If you can’t understand the basics what is the point of trying to regulate it?

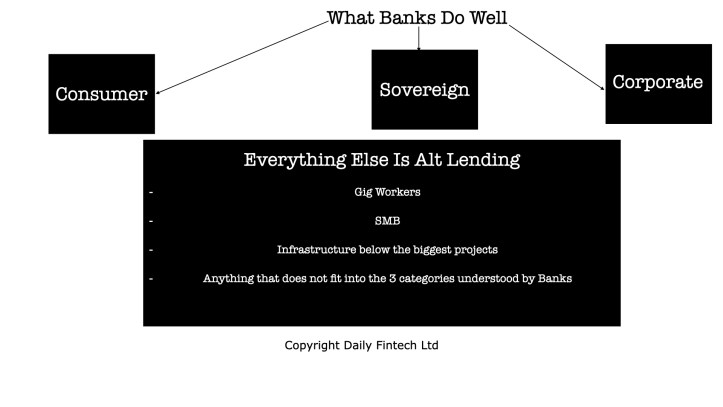

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.