Alt Lending Week Ending 10th December 2021

EU care more about its Euro project than financial stability

Although this piece relates mainly to the ongoing EU attempts to pull financial services business out of London particularly clearing services it does make some rather stark observations about what is going on in the Eurozone and why we should all be more than a little concerned. In particular Barnabas Reynolds hones is on the fact that EU law and regulation require EU financial firms to treat member states sub sovereign paper as sovereign. It also points out that the EBC hold rather a lot of this type of paper and the EU with no sovereign lender of last resort is funding the whole of the Eurozone based on this stuff. Most interestingly he claims that some of the costs of this policy through dodgy accounting practices like not recognising non performing loans for what they actually are. Due to this odd method of accounting liabilities appear to funded by some of the stronger members of the zone when in fact they are not. Highly misleading. It makes you wonder how many Eurozone based banks are actually technically insolvent. This article revisits the old conundrum that the Eurozone as a monetary system is not fit for purpose and that at some point this will be discovered by a default by a clearing institution.

Shell decides against Cambo field.

In our dash to reach net zero it looks like we are actually losing the ability to think clearly. Shell decision to pull out of developing the Cambo oil field in the North Sea makes no sense except for the eco zealots which unfortunately seem to have a number of politicians in their ranks. In addition the banks are also concerned about ethical investors giving them a hard time. These guys of course hope that the lights will not go out within time for the next general election but I cannot help feeling that this project green might turn out to be project cold. In the UK we have found out over the last few days about our reliance on electric power systems and their vulnerability to extreme weather. Like it or not we are going to be reliant on fossil fuels for quite a number of years yet. It goes to show how the elites political plays stop them making good investment decisions. At least if we produce oil in the UK we don’t have to hand the begging bowl to Mr. Putin.

Bank of England to ease affordability checks on home loans.

I suppose we are where we are and regulation and control of our supposedly free markets are everywhere to be seen. Undoubtedly the housing bubble that we currently have is something to do with printing money of QE of money which has transferred money from the poor to the rich and from the rich to the richer. So the government wants to level up in order to solve a problem it created in the first place. It now finds itself in a position where property prices have got so high that ordinary people can’t afford to buy them. So it eases the criteria hoping that higher wages will allow people to afford what is unaffordable. This might make the situation worse and create a bubble. Of course it will. So then they will try and do something else equally stupid. The government and the bank of England should have stopped interfering in the credit markets years ago.

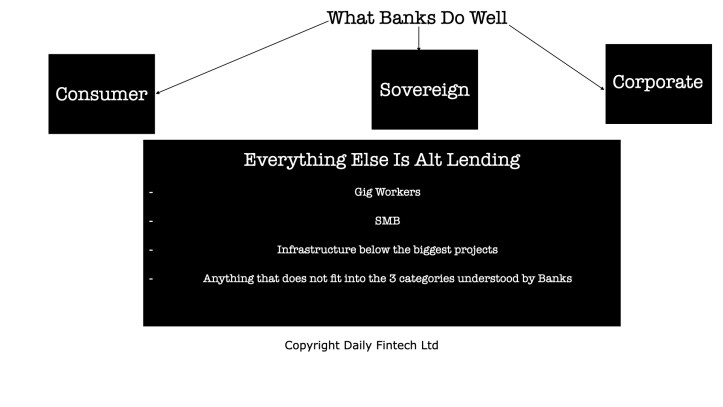

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.