Alt Lending Week ended 5th November 2021

Co-op bank snubbed in TSB takeover approach

This story was covered in the main press outlets and it particularly relevant to the challenger banks in the space. Over the past few years both Co-op Bank and TSB have had their crosses to bear but now Co-op has returned to profitability and has a relatively strong balance sheet and not much in the way of legacy problems. TSB has suffered following a technical meltdown a few years ago. Their owner Banco de Sabadell has initially turned spurned the offer but that is not how all the news media see it. I have always thought that TSB and Sabadell did not look good together and although the bid is currently around £ 1 billion, some £ 700 million less that Sabadell originally paid I think that Co-op are playing a somewhat longer game. There are several factors at play here. Potentially rising interest rates in the UK is one which affects all the newcomers as they haven’t found ways of utilising the funding they have profitably. Secondly foreign owners from some countries are likely to look closer to home as the aftermath of COVID sinks in. Lastly there is the two tier valuation conundrum that is valuing digital assets at several times conventional businesses despite established businesses being profitable and do not need constant capital injections. Watch this space.

Jonathan Rowland plans 2023 float for Redwood Bank

I cannot think that this is a very ambitious move in what is a febrile and crowded space. Nevertheless good luck to them. This week they have announced an overhaul of its board prior to an IPO timed for 2023. The Bank is somewhat unusual in that it is partially owned by Warrington Borough Council a Labour run municipality and the council’s auditors Grant Thornton highlighted “weaknesses” in the way it bought a £ 30 million stake in the bank some four years ago. A couple of months ago the bank had to defend what appears to have been a somewhat risque credit decision in lending £150million to THG a Manchester based e-commerce outfit. THG’s shares have lost around 80% of their value in the last year. In any case it looks like an interesting story although a quite risky one. It’s easy to get caught out these days.

Investors obsesses with finding next tech superstar

Following on from the story above Ben Marlow notices a certain naivety from City of London investors when it comes to picking the next tech winner. He suggests that it is the fear of missing a real winner that might be driving investors to plump for what are quite ordinary companies in the tech space just because they have a tech tag. He cites THG as being a good example of this growing phenomenon. What is interesting however is where he places the blame. He calls out highly paid analysts and fund managers who in their enthusiasm to find big tech winners are willing to accept all kinds of financial hyperbole rather than doing their jobs properly and asking the right questions. The question of tech stock valuations particularly in the banking sector is never far from my mind particularly when you look closely. Almost always there is a degree of hopefulness that is not justified by the underlying numbers. Eventually the winners are separated from the losers but by then it’s too late.

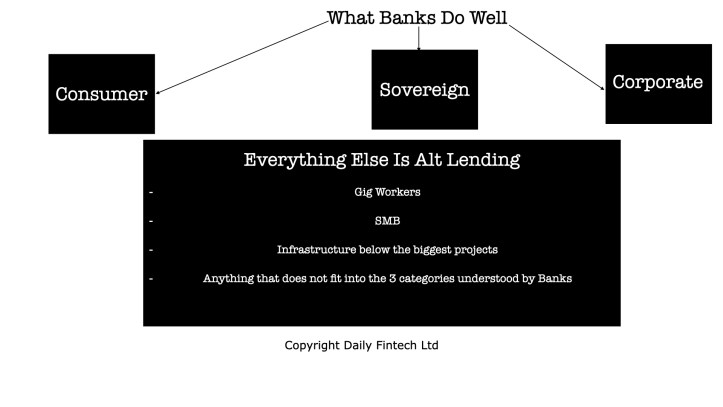

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.