Alt Lending Week Ended 4th June 2021

Archegos faces probe by department of justice.

Family office or hedge fund ,take your pick. What is sure is that Bill Hwang’s leveraged bets are now going to be closely looked at by the US department of justice. Prima Facie the story doesn’t look that complex. Archegos got margin calls from lenders that it could not meet and then had to conduct a fire sale. However that led to some $35 billion being wiped of the value of a whole swathe of stocks. The DoJ is not suggesting any wrong doing took place but it has asked several major banks for information on the ensuing unwinding. After all Hwang could have only done what he did because banks lent him the money to do it. The hit however was very widespread and arguably caused by imprudent lending largesse. It will be interesting to see where it all leads but there is a feeling of déjà vu following on from 2008. Did anyone learn anything?

Ex editor of the Daily Telegraph, Lord (Charles) Moore touches on the plight that some people, even very respectable people have in opening UK bank accounts with mainstream banks. In this case three friends of Lord Moore have all been refused for opening a new bank account either for a small business or a not for profit organisation on the basis that they are not existing clients. One of these august organsations is Queen’s banker Coutts. The excuses for turning away this business must have been interesting to hear. Covid features prominently, naturally but apparently some of those refused were in fact existing clients. Lord Moore cuts to the chase that the real reason for the refusals is ultra low interest rates. When government policy causes banks to turn away deposits because it cannot lend it out profitably the raison d’etre of retail banking ceases to exist. This is exacerbated by the costs of compliance in myriad rules and regulations. The end result has been that total mispricing of flexible overdraft funding. When I started out as a banker 29% over base as a lending rate could not have existed. We are not being led to a good place.

Bank of England cuts back on International travel?

This intrigued me. I know that Bank of England executives are essentially bureaucrats but they represent an important international borrower and as such should know as many people as is appropriate. Banking is supposed to be a relationship business and compliance insists that you Know Your Customer . However relying more on virtual relationships does not seem a particularly good way build trust. I hear stories every day from people who cannot fund deals which would surely have been no brainers only twenty years ago. There is definitely a niche in the market for the old fashioned Merchant Bank in which bankers skilled in the risks and security structures of international projects and trade could develop profitable business. These people knew their clients inside out, had a good feel for risk and how the spoils should be fairly divided. Happy days.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

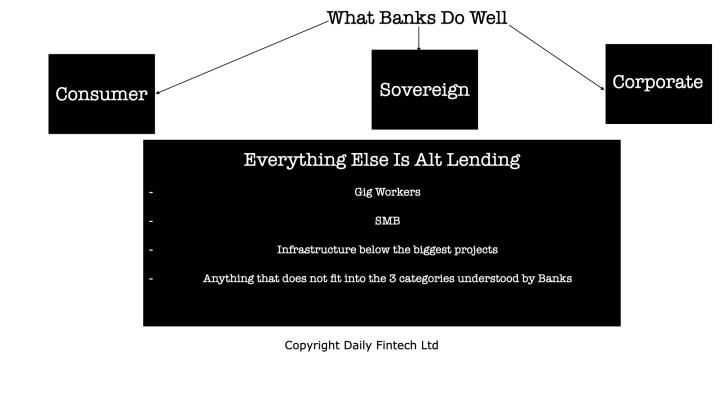

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.