Alt lending Week ended 24th December 2021

The perils of offshore bank accounts?

The UK supreme court has overturned a ruling made by a lower court and refuses to recognise Nicolas Maduro as the legitimate leader of Venezuela following what were widely perceived to be rigged elections in 2018. Maduro was trying to argue that some £ 800 million of gold held by the Bank of England could be withdrawn and put under his control. Surely a wise decision considering his appalling track record. It got me thinking about the days back in the early 1980’s when debt collection on a country wide scale was my responsibility. The country concerned was Greece. Whenever a company went belly up it was almost standard practice to check the owners and see if they had offshore bank accounts. They usually did and it was predominantly in Switzerland. Identification was usually quite easy but recovery was another matter. At the time the bank I was working for had a slogan “man on the spot”. This was intended to relate to there being bankers present in some exotic locations. For those collecting bad loans that they personally had not made it was a lot more sinister.

Bumper brings BNPL to car repairs

When I saw this I almost fell off my chair. Both Jaguar and Porsche have apparently backed this which bring the current craze of buy now pay later into the world of car repairs. The founder James Jackson is obviously hoping to benefit from the obscene valuations that have been a feature of other similar companies such as Klarna. He apparently started the company when he took his old banger to get a service and ended up with a massive bill. He says there had to be a better way. Bumper allows the repair bill to be split into six periods. But whoever owns the car still has to pay the bill and presumably interest needs to be paid by someone meaning the bill is even bigger. I am not sure I see the improvement here or for that matter the value added. Good luck with the model but I can’t help thinking that clients attracted to this kind of lending will be those who, let’s be charitable, might be less than flush with readies and probably always are. I have been in lending a long time and suspect that like Klarna, bad debts will follow as sure as night follows day.

UK Company insolvencies double in a year.

This news is not surprising at all. The past couple of years we have not been living in the real world and a lot of zombies have lasted out this long thanks to generous support facilities. The U should not be singled out everyone has been at it. The tide has gone out and surprise, surprise these are some naked swimmers. I don’t pretend to know what will be happening this time next year but I don’ think it will be pretty. I would like therefore to offer a little bit of advice to those lenders who have to make and support ongoing credit decisions for their clients. Watch account activity closely, compare the trends, follow the numbers, keep close contact, ask difficult questions and don’t get fobbed off. If something looks like it is going south it probably is. The key to being a good credit manager is understanding how the business you are lending too actually works and acting accordingly. I don’t think technology will help you too much. Merry Christmas and a Great New Year.

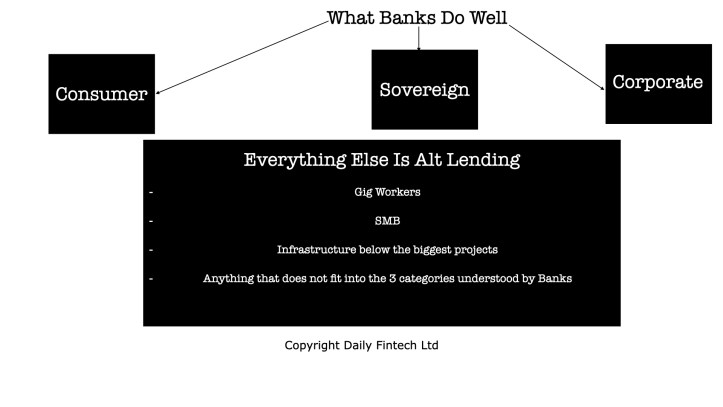

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.