Alt Lending Week ended 23rd April 2021

Bankrolling football’s breakaway rebels is an own goal for JP Morgan

Practically all serious newspapers run this story but I liked Ben Marlow’s take on it. The new European super league has created a backlash of extraordinary ferocity across Europe particularly, of course, it’s supporters but also many establishment features. I particularly noticed the slogan scrawled across a banner being displayed by Manchester United fans which said “created by the poor stolen by the rich”. I will not dwell on the rights and wrongs of this episode but JP Morgan is very publicly facilitating this deal which is potentially the most egregious example of the unacceptable face of capitalism, and banking, that we have seen since the financial crisis of 2008. What’s more it is mainstream conversation among tens of millions of ordinary Europeans. At the same time JP Morgan is trying to enter the world of digital banking in the UK under the Chase Manhattan banner. Seems like Mr. Dimon does not quite get the European view on sport. This is a very political story and likely to reflect very badly on JP Morgan and capitalism in general. At the time of writing it looks like the whole ridiculous idea is going to fall over but the 12 clubs and the bankers have shown their true colours and it will not be forgotten easily.

Goldman takes £ 50 million stake in Starling

While this is just pin money for Goldman and they have stated publicly it was a private equity investment and not connected presumably with any kind of strategic interest it certainly counts symbolically. Certainly CEO Anne Boden thinks so commenting that the Goldman connection will help them with their lending activities. We will see but lending profitably is going to be a big challenge over the next few years. Ms. Boden has built a valuable asset within what is becoming quite a crowded space. Is technology loosening the grip of the big four UK lenders? I couldn’t help notice that competition is providing 95% mortgages in the UK outside of the newly arranged government scheme. Was that supposed to happen? I don’t think so but it demonstrates the errors that are being made to support the UK housing market. Then end result will be to make properties even less affordable than they are now.

Banks mindful of mental health training staff to handle upcoming COVID debt collection

This story appeared at the weekend and shows the seriousness that is being attached to the undoubted bad publicity that will be forthcoming from the attempts banks make to recover sums advanced under the various, government guaranteed COVID support mechanisms. I cannot help but feel somewhat sorry for any institution that has got itself caught up in this and particularly the Fintech newcomers practically all of which are headed up by technical specialists. Undoubtedly they were pressurised to help out but the initial requirement to bring something to market quickly trumped all other considerations. The result will be huge bad debts, depression, suicides etc. and the bans will take some of the blame when it is really the government that should take the wrap. Life isn’t fair and some of the borrowers who took out these support facility never intended to repay them in the first place. The people who are going to have the sleepless nights are those who borrowed because they had no choice as the UK government had shut down their businesses through no fault of their own. It remains to be seen how it all pans out but I do not expect good outcomes. This is a lose-lose situation however one looks at it.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

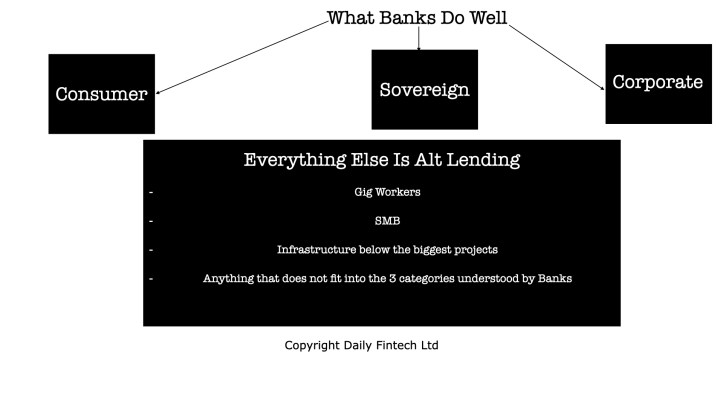

For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.