Alt Lending Week Ended 1st April 2022

NatWest back in private hands, Just?

The continuing saga of the sale of NatWest looks to be as long running as the Mousetrap. The latest sale, orchestrated through Morgan Stanley, reduces the government’s stake to 48.1% and like Gordon Brown’s handling of the UK Gold reserves is crystallising large losses for the taxpayer. This is a really sorry tale from the Hubris and supercharged risk taking of Fred the Shred to the ridiculous purchase of part of ABN Amro for a ludicrous price and the involvement of billions of sub prime mortgage assets. My god what a shambles. I don’t think many people understand how close the bank with the biggest balance sheet in the world came to total collapse although this is pure hearsay. A senior trader at RBS Markets treasury in Bishopsgate told me in the bar of the White Hart on Liverpool Street that the bank were $36 yards short at close of business and the funds didn’t arrive until after 1pm the following morning. It came really that close.

Boris Johnson in love affair with Nuclear.

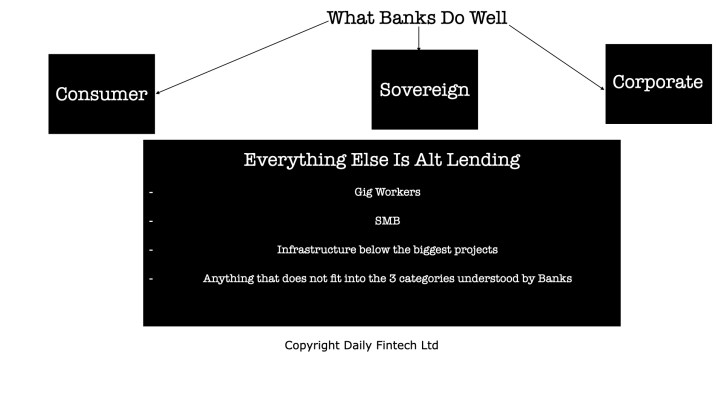

Martin Vander Weyer’s weekly column in the right of centre and respected magazine the Spectator finds that after he takes just one weeks holiday, when he returns Johnson is a changed man advocating all kinds of investments in Nuclear, North Sea Oil and Gas. He takes a swipe at Johnson suggesting that the timing might have something to do with upstaging his Chancellor Rishi Sunak’s spring statement. Personally I don’t care what the truth is. I look at a lot of innovative energy projects and the sponsors of them all tell me the same thing. The big problem with getting their ideas sponsored and financed is that the government keeps getting in their way and that two many large companies with vested interests keep encouraging them to do so. Everyone knows our energy policy like many other of the key policy areas fomenting daily in a working from home environment somewhere in the home counties by our worse than useless administration are just not up to the task of a fast moving and dynamic industry that needs innovative thinking and not yesterday’s men and ideas. There are more projects out there than you can throw a stick at them. Financing them however is another thing altogether. The UK banking system has decided that structured leveraged assets are not really for them unless they are absolutely huge. What a shame.

Inflation spurs rise in Credit Card debt. Drop in savings.

What a surprise. Has anyone told Rishi? When prices start to rise why wait to make that capital purchase? Might as well bung it on the Credit Card and pay it off later with your devalued salary. Why save money when it will buy you less in future? The results of government policy were clearly foreseeable. I am old enough to remember real inflation. Believe me it is a killer. Banks have pulled out of the overdraft business making it ruinously expensive. Credit cards are sometimes much the best option. The fact is that the price of credit has nothing whatever to do with the underlying risk and relationship banking where you get some advantages for customer loyalty is long gone. Go for it while you still can.

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.