Alt Lending week ended 13th August 2021

Tesco Bank gives up the ghost. Who can blame them?

Tesco Bank decided in December 2019 to stop offering current account services to new customers and followed up in July this year by confirming that existing customer accounts would be closed on November 30th this year. Not surprisingly the 250,000 current account customers affected decided to use the CASS switching service. Unsurprisingly Tesco Bank could not meet the high demand and temporarily suspended current account switches. It was the sub text that interested me. Tesco has already ditched its mortgage book selling it to Lloyds in 2019 because of “challenging market conditions.” They blame the latest decision on the fact that only an estimated 12% of clients used their Tesco account as a primary account! Tesco, along with everyone else in the early stage banking institution business have found out the hard way that the near zero interest rate scenario we find ourselves in is not conducive to making profits. Banking is not just about taking deposits. If you can’t earn anything on the money then services will not make up the difference. Tesco is a large grocery business. It will never be a proper bank. As to CASS this is a flawed idea brought about by half witted regulatory ideas.

Tom Rees in the Telegraph reminds us that credit conditions here in the UK and I daresay every other country in Western Europe are going to become more stringent as various governments start to wind down their various support arrangements. Rees says that the industry in the UK is in a better position than first thought and liquidity in the UK is robust but I suspect that some Eurozone members will find life quite challenging. Many banks are completely reliant on the ECB for liquidity and have been in this position for a considerable length of time. Not that the UK is out of the woods. The task of winding up the various UK schemes will be considerable with a wave of bad debt and recriminations looking capable of complicating banking operations and overwhelming administrations for some time. Perhaps we should be thankful for small mercies. Hedge fund guru Crispin Odey remarks that despite inflationary pressures the BofE will never put up interest rates. I agree but only because they can’t without causing even greater damage.

Ex Chancellor Hammond accused of breaking ministerial code with Oak North tool Kit

Seems like ex politicians can’t keep their fingers out of the banking sector. Hammond’s misdemeanour was to try and get the treasury to try out a so called Covid stress testing toolkit developed by OakNorth , a bank who uses him as a paid adviser. Oak North are heavily involved in technology for credit theories and assessments and apparently the opportunity afforded to the Treasury had no financial strings attached. Given the frothy value of Fintech banking applications, however, the kudos attached to the UK treasury actively testing an OakNorth strategic asset would of course add considerable value to the bank’s credibility. In fact I commented on this aspect of OakNorth’s activities some time last year in this column. The gist was that this application could eventually end up being more valuable that the rest of the bank. I don’t see any reason to change my mind on this although I am not even sure what this app does. Our faith in technology to solve complex qualitative problems is to me unproven. Didn’t Greensill use technology?

Howard Tolman is a well-known banker, technologist and entrepreneur in London,

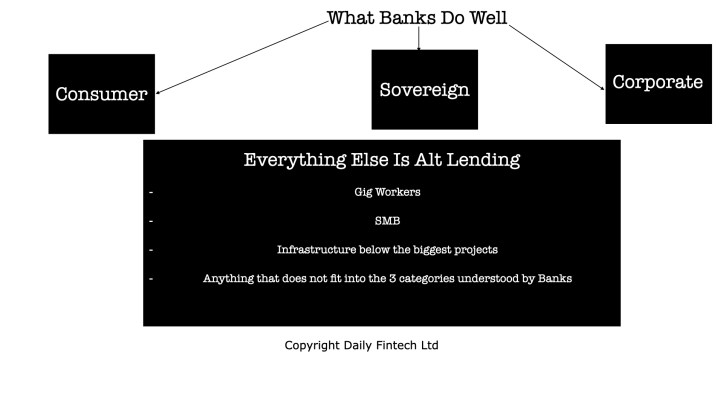

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.