Alt Lending week ended 12th November 2021

The great challenger bank experiment has failed

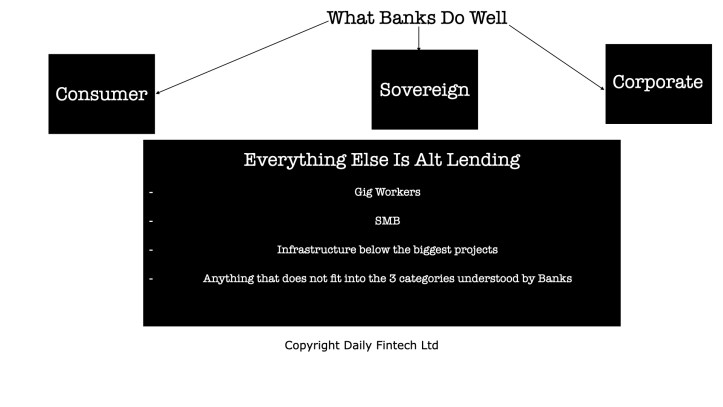

Good Saturday morning reading from Ben Marlow but definitely not for the faint hearted. He takes the view that banking is really all about scale and as evidence presents the proposed takeover of Metro Bank by Carlyle as a step in the road to, perhaps, create a scaleable vehicle somewhere down the road. The proposed takeover of TSB by Co-op bank is characterised in the same defensive fashion like a couple of one legged men in an ass kicking contest. And he has words to say for the Tech boys and those who back them. The fundamentals cannot be magicked away by flashy apps? The fundamentals he is talking about are, of course, practically zero interest rates. Last week in the face of expectations in lending rates the BofE decided interest rates were not going to rise. To justify this it seemed to suggest that this just couldn’t happen. If not now when? We live in interesting times but I think Ben is right. The big banks are the only ones that are going to keep afloat and everyone else is going to have to do either radical or downright stupid things like gravitating into risk areas that they just don’t understand.

Is Germany now Eurozone’s weakest link?

One of the major effects of the pandemic has been its impact on manufacturing with all the disruption to supply chain and shortages of vital components. Arguably within the Eurozone this has hit Germany harder than anyone else. The impact that this might have on the German banking sector and the Eurozone as a whole is potentially huge but nobody seems to be considering it seriously. The slowdown in manufacturing which is compounded by the huge changes in technology and consequent product shifts is going to leave a lot of German companies in zombie like shape and the changes which will be needed to alleviate the problem will take a considerable amount of time to filter through. This can only hinder the efforts that will be needed from the country’s banking sector to help reshape the economy and allocate resources to optimise the changes. Despite the economies of Italy, Spain, France, Portugal and Spain growing somewhat faster than Germany I somehow cannot see how they can pull the whole zone out of the malaise it is in when the most efficient economies are struggling.

Can Horta Osorio rescue Credit Suisse?

Now there’s a question. The Portuguese banker has built up quite a reputation from turning Lloyds around after the 2008 lesson in how investment bankers should not behave. But I’m not so sure that this was a really difficult task. As far as I can recall from my banking days Lloyds was just sleepy and not making the best use of a strong balance sheet. It did not look like it was going bust. Credit Suisse on the other hand is a different kettle of fish. The Telegraph article on Friday of last week asked some questions but on Monday we learned that as a result of the decision to pull out of Prime Brokerage (PB) it was encouraging its investment banking clients to move their business to BNP Paribas much like Deutsche did a few years ago. BNP’s new business department, not an unrivalled giant in the investment banking game must be pleased as punch. But for a bank of Credit Suisse’s supposed stature to pull out of PB, one of the key planks in an investment banking franchise, smacks of panic or lack of understanding or both. Particularly if you are following a strategy to boost wealth management to plug the revenue gap. After all, if you can’t look after your own money, why should you be any different when looking after anyone else’s?

Howard Tolman is a well-known banker, technologist and entrepreneur in London,We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.For context on Alt Lending please read the Interview with Howard Tolman about the future of Alt Lending and read articles tagged Alt Lending in our archives.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.