Xiaomi battles law enforcement and competition in India

As the managing director who brought smartphone vendor Xiaomi to India in 2014, Manu Kumar Jain was the face of the Chinese-owned company. He even danced in its ad campaigns.

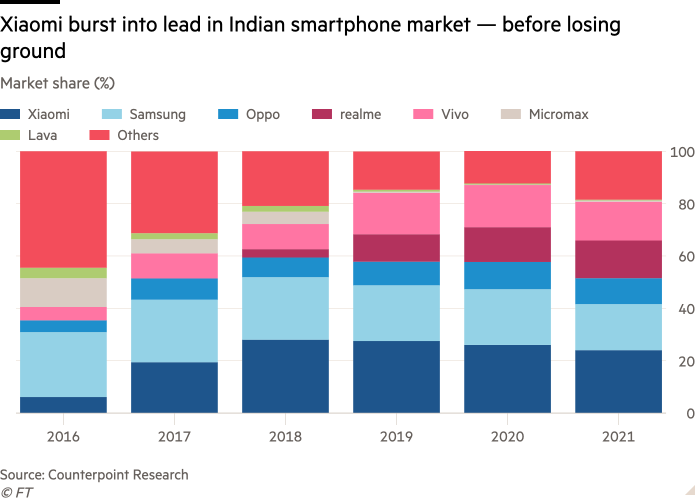

Under Jain, Xiaomi’s rise was swift. It jumped from 6 per cent of India’s smartphone market in 2016 to 27 per cent three years later, beating Indian brands and South Korea’s Samsung and paving the way for other Chinese marques. Today, about three-quarters of India’s market is controlled by Chinese-owned companies.

With Jain the poster boy for India’s mobile phone revolution, Xiaomi says it has sold more than 200mn smartphones in the $38bn revenue market. But that meteoric rise is at risk, with India’s financial enforcement authorities accusing Xiaomi of unlawfully remitting $725mn abroad.

The case is being watched for what it means for the future of Chinese tech groups in India, as the previously decimated local competition tentatively revives. Billionaire Mukesh Ambani launched the affordable “JioPhone Next” last year, although it has yet to make an impact.

India has an uneasy relationship with the Chinese technology it relies on. After fatal 2020 border clashes, it banned many Chinese apps, including several made by Xiaomi, while making clear that telecom companies should not use Huawei technology.

Given “escalating geopolitical tensions between India and China, many may be tempted to view this investigation as part of an orchestrated campaign against Chinese economic interests in India”, said Promod Nair, a senior advocate.

The Indian courts must “resolve the dispute quickly and dispassionately in order to dispel any apprehensions that foreign investors may have about the investment climate”, added Nair.

Although Xiaomi is not provisioning for losses, trouble with the Indian authorities creates more challenges as it defends its dominance in the fast-growing market, and as it contends with investor doubts — Xiaomi’s share price has tumbled 40 per cent in Hong Kong this year.

When it arrived in India, “Xiaomi came and took the market by storm”, said Prachir Singh, an analyst at Counterpoint Research.

Xiaomi moved faster than rivals to supply 4G-ready handsets when Ambani’s Jio mobile network upturned India’s telecoms market in 2016 with cheap 4G services. It kept costs down by selling Redmi phones online for less than Rs10,000 ($130) through ecommerce platforms such as Amazon and Flipkart, at a time when, Singh said, “nobody thought it could be done in an online scenario”.

Through partnerships, including with Taiwan’s Foxconn, Xiaomi’s phones were largely manufactured in India under the government’s “Make in India” scheme. Jain posted selfies with Prime Minister Narendra Modi.

Met H’ble @narendramodi, with CEO @leijun. Shared @XiaomiIndia‘s journey & #MakeInIndia plans. Great times ahead under his advice. @PMOIndia pic.twitter.com/3jgbnbn4UK

— Manu Kumar Jain (@manukumarjain) March 27, 2017

But rival low-cost Chinese brands now threaten its market share — Oppo, Vivo and realme arrived after Xiaomi disrupted the market.

Xiaomi said it put “small changes” in its market share down to “supply chain disruption. We expect [the] supply situation to normalise by the end of this year.”

In an effort to reduce its reliance on the Redmi brand, still its biggest seller, Xiaomi is expanding in the premium smartphone segment. It has pushed into wearables and is India’s top smart TV seller. By increasing its bricks-and-mortar presence, Xiaomi says offline now accounts for “half” of its smartphone sales.

But Xiaomi India took a hit to its bottom line during the pandemic. Filings with India’s corporate affairs ministry show Xiaomi India’s profits after tax fell 31 per cent for the financial year ending March 31 2021, from Rs4bn ($51mn) to Rs2.8bn.

“Nobody goes out of the way to discuss profitability,” said a former executive. “You can’t remain a start-up for more than four years.”

In India, legal experts say Modi’s government is aggressive in pursuing corporates. Samsung was stung by tax evasion charges last year, and US company Amway had assets frozen this year.

“The regulatory intensity in the country under this government has generally been very high,” said Debanshu Mukherjee, co-founder of the Vidhi Centre for Legal Policy in New Delhi. “Their (enforcement agencies) prioritisation seems to be loaded with some politics at times.”

However, Mukherjee added: “It’s not that they would go after folks without any violation whatsoever.”

Xiaomi’s woes began in December when Indian revenue officials raided the premises of “foreign-controlled” mobile phone companies. Days later, the Directorate of Revenue Intelligence alleged Xiaomi had “evad[ed] customs duty”, and demanded Xiaomi pay about $85mn.

Then last month India’s Enforcement Directorate alleged that, since 2015, Xiaomi had violated strict foreign currency laws by sending $725mn out of India labelled as royalties, “on the instructions of their Chinese parent group entities”.

Xiaomi denies unlawful payments and its lawyers argue other companies made payments to an unnamed US company without censure.

But freezing $725mn in Xiaomi’s bank accounts left Xiaomi “not in a position to pay salaries/wages to its employees”, Xiaomi’s lawyers told a High Court judge, who permitted Xiaomi to use its accounts for business expenses, court filings show.

The dispute became acrimonious when the Enforcement Directorate denied allegations that its officials had threatened Xiaomi executives, including Jain, triggering a diplomatic salvo from China.

The Chinese embassy said it hoped the “Indian side can provide a fair, just and non-discriminatory business environment for Chinese companies”.

Meanwhile, Jain, once a symbol of how Xiaomi stormed into India’s tech scene, is no longer in charge. He is located in Dubai and is now a global vice-president at Xiaomi, according to his Twitter profile.

Xiaomi said that since mid-2021, its India business had been managed by chief operating officer Muralikrishnan B, chief business officer Raghu Reddy and chief financial officer Sameer BS Rao. Despite Jain’s departure, Xiaomi insisted “there is no leadership vacuum”.