XBRL News about derivatives, open standards and ESEF audits

Here is our pick of the 3 most important XBRL news stories from the last week.

1 ISDA publishes first digital definitions for interest rate derivatives

The 2021 ISDA Interest Rate Derivatives Definitions are the first ever to be published as a natively digital definitional booklet, and are available via ISDA’s new electronic documentation platform, MyLibrary. The digital format will create significant efficiencies in how firms use and interact with the definitions, reducing complexity and the potential for error.

The International Swaps and Derivatives Association (ISDA) is the global powerhouse setting standards for institutional Over The Counter (OTC) derivatives – the real stuff. They are quickly moving to adopt data standards and technical interface integration, too.

2 Using open data standards: a case in point

In an age that floods us with data, we need open data standards for orderly datasets. You might ask yourself, what are open standards? Open standards for data are documented, reusable agreements that help people and organisations to publish, access, share and use better quality data. Open data standards must support the interoperability of data, which in this context, ensures the ability to interoperate different datasets.

A really nice introduction into how XBRL fits into the global open data standards landscape. Difficult to digest for the NIH (not-invented-here) crowd …

3 Netherlands offers a model for ESEF audit

How can we facilitate effective and efficient assurance of European Single Electronic Format (ESEF) filings, and make it possible for auditors to do their jobs without needing to understand the technical aspects of Inline XBRL? Jacques Urlus, policy advisor IT & Audit at the Royal Netherlands Institute of Chartered Accountants (NBA) and Vice Chair of XBRL NL, explains his model for doing just that, in the latest in a series of guest posts over in the Taggings section of the XBRL International website exploring ideas from April’s Data Amplified Virtual.

One of the biggest issues with XBRL reporting (aside from its delayed release) is that it is not usually part of audited statements and therefore continues to contain unnecessary errors. With the advent of the ESEF mandate, this is about to change in the EU, at least. Different approaches to resolving these digital assurance issue exist – watch this space.

—————————————————————

Christian Dreyer CFA is well known in Swiss Fintech circles as an expert in XBRL and financial reporting for investors.

We have a self-imposed constraint of 3 news stories each week because we serve busy senior leaders in Fintech who need just enough information to get on with their job.

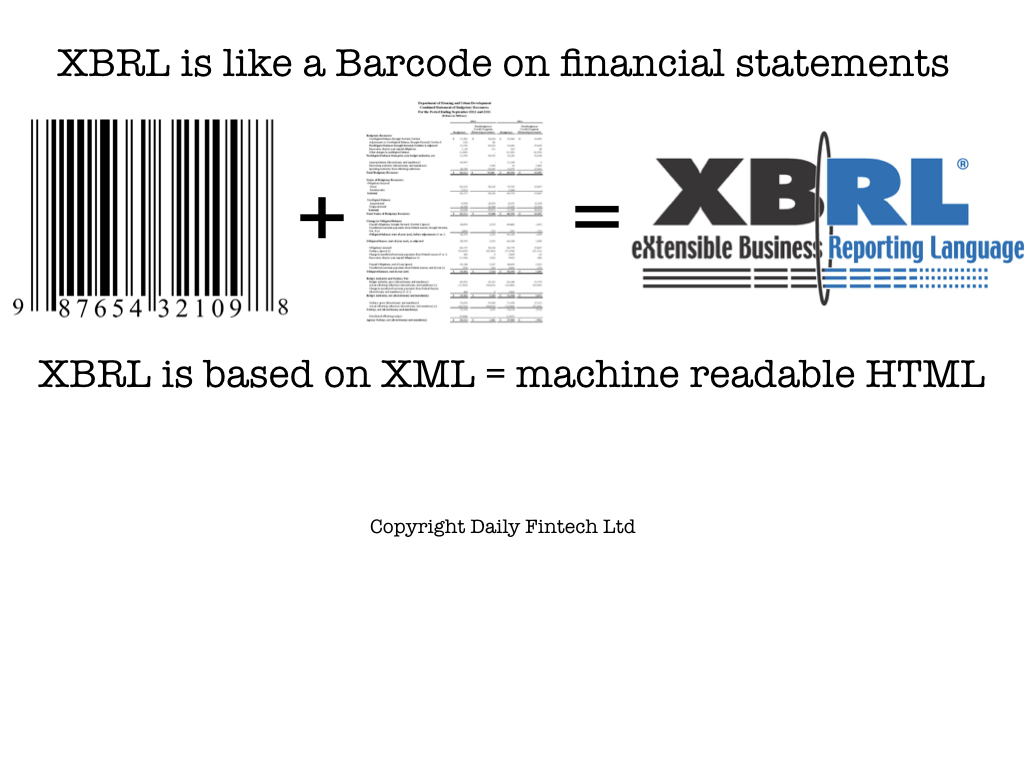

For context on XBRL please read this introduction to our XBRL Week in 2016 and read articles tagged XBRL in our archives.

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just USD 143 a year (= USD 0.39 per day or USD 2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.