Will Rivian’s blockbuster IPO make it the next Tesla?

Jeff Bezos recently called RJ Scaringe, the 38-year-old founder of the electric vehicle start-up Rivian “one of the greatest entrepreneurs I’ve ever met.”

He then added: “Now, RJ, where are our vans?”

His comments capture the huge hype around Rivian, but also the heavy burden of expectations on it, as it prepares to list in New York on Wednesday in the biggest initial public offering for a US company since Facebook’s debut in May 2012.

After the start-up raised its price range on Monday, its valuation may reach $67bn, which would give it a larger market capitalisation than Honda and Hyundai and make it worth more than 80 per cent of Ford, one of its biggest backers.

The IPO comes a few months after Rivian began producing its electric vehicles and the company only expects to ship just over 1,000 this year.

But its prospects have been burnished by an order from Amazon for 100,000 electric delivery vans by 2025, and by the belief that Rivian’s stylish pick-up trucks may attract the same fervour as Tesla’s sports cars and sedans.

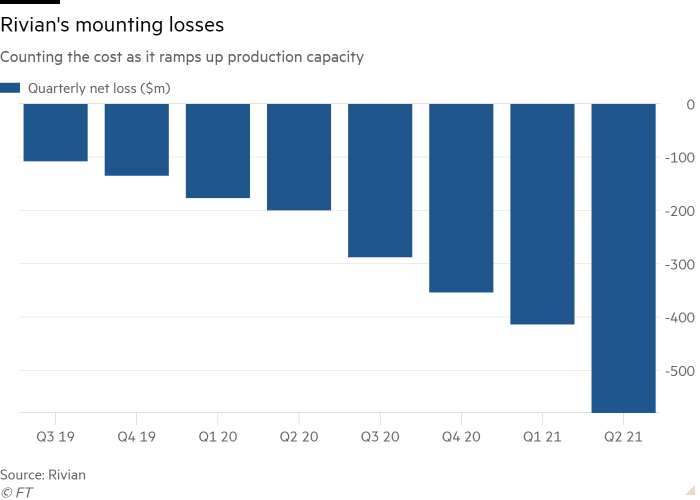

Rivian hopes to raise about $10bn from the IPO. Much of it will be spent on ramping up production, building on its current capabilities in Normal, a town in Illinois, where its factory — a former Mitsubishi plant — has the capacity to build 150,000 vehicles annually. It has plans for more facilities internationally.

The cash boost will come on top of astonishing sums raised in the private markets, with investors pouring in $11.15bn since the company’s founding in 2009; $10bn of it coming in since 2019. Rivian has not been the only company to benefit from investor eagerness around mobility start-ups. According to PitchBook, more than $75bn has been invested in the sector in the past year alone.

“This story of electrification is broader than just moving people around,” said PitchBook analyst Asad Hussain. “There’s more and more focus from investors on logistics. Mobility and supply chains are at a convergence of innovation, and Rivian sits really at the centre of that.”

Founded in 2009 by Scaringe, Rivian — originally named Mainstream Motors — set out to make a small electric sports car, a project soon abandoned. It was “increasingly clear”, Scaringe would later write to investors, that the car would do little beyond what had already been achieved by Tesla.

Instead, Scaringe decided to create an adventure brand in the mould of North Face or GoPro, spending a decade quietly developing battery tech and designs before unveiling two models at the LA Auto Show in 2018: the R1T pick-up truck and the R1S SUV.

The pivot was well-received, said Galileo Russell, a renewable energy investor, and board member at electric vehicle maker Arcimoto.

“Rivian had their own vision that I thought was dope,” he recalled of the event. “They weren’t trying to just copy Tesla.”

But, he added: “I also think Tesla’s success has inflated their valuation and people are assuming that what Tesla has done can be easily replicated.”

By this point, Rivian had already attracted the attention of Jeff Bezos, the then-chief executive of Amazon, who visited Rivian’s Michigan headquarters in late 2018 to meet Scaringe.

By February 2019, Amazon led a $700m round of investment — its first of several. It later revealed that the delivery van order would be a key part of its pledge to eliminate its carbon emissions.

PitchBook analysts value the arrangement as being worth $4.5bn to Rivian, when factoring in additional after-sale revenues, such as maintenance.

In a regulatory filing, it was revealed that Amazon held a 22 per cent stake in the company and, with it, a suite of exclusivity rights to Rivian’s technology. Rivian wants to offer its delivery vans to other companies, but it will not be able to until at least 2023.

Amazon’s involvement, the best possible endorsement of Rivian’s commercial potential, sparked a flurry of new investors. They included Ford, even though its own pick-up range, the F-series, would be affected by Rivian’s rival model.

General Motors was also an early suitor, and held intensive talks in the hope that Rivian would help it take on Tesla.

But after a window of exclusivity between the pair lapsed, Ford made its move, led by then-operations chief Joe Hinrichs. Scaringe and Hinrichs bonded over dinners and ultimately thrashed out the bulk of the deal on a private flight using Ford’s commercial jet from Seattle to Detroit, all while GM was still preparing a press conference to announce its own investment.

In April 2019, Ford invested $500m — later rising to $1.2bn — and took a seat on the board, to the immense chagrin of its Detroit competitor.

Ford, led at the time by former Steelcase boss Jim Hackett, was in a state of “panic” about its own electric capabilities, said one person with knowledge of the transaction. “There was a whole load of hype around all the start-ups, and we panicked and thought we needed to be part of that,” recalled the person.

One clause of the deal was that Ford would create a vehicle using Rivian’s own architecture — the so-called “skateboard” of batteries and components that could power many different types of vehicles.

But Ford, which replaced Hackett with former Europe boss Jim Farley as chief last year, has now ditched its plans to make Lincolns using the technology, and has significantly scaled back its involvement with the start-up, said several people close to the company.

People close to the company say Ford has since ramped up its in-house electric efforts, taking the wraps off its F-150 Lightning battery truck and the Mustang Mach-e, which both use proprietary systems and were in development at the time Ford invested in Rivian.

With such hefty competition looming, cautious analysts worry that Rivian’s valuation is pricing in success that is not guaranteed.

Laura Schwab, former vice-president of sales and marketing at Rivian, said she had warned the company its delivery targets were “not achievable”. Schwab is at present suing Rivian over what she claims was her unlawful firing two days after making a gender discrimination complaint.

Of the 100,000 delivery vans ordered by Amazon, only a handful of test vehicles have been put on the road so far, with production set to start by the end of the year.

Meanwhile, Rivian has enjoyed the plaudits for getting its pick-up truck off the production line before its competitors, but of the just over 50,000 pre-orders placed for the R1T and R1S models, just 156 have been delivered so far, the company said — “nearly all” to Rivian employees.

In comparison, Ford’s F-150 Lightning, the first electric version of its top-selling pick-up, has received more than 160,000 pre-orders — and will start being delivered to customers this spring.

It leaves little room for error, and new automakers can often suffer quality control issues, analysts say, particularly against a backdrop of pandemic-related supply disruptions.

“It’s difficult enough for established automakers, let alone a new one,” said Ivan Drury, senior analyst at Edmunds. “Couple that with this new issue the entire industry is dealing with, the chip crisis, that just adds another layer of complexity.”