Waiting on Washington and China’s unwitting hackers

Hi everyone! This is Ting-Fang from Taiwan. I got a call over the weekend from a real estate agent who I interviewed a few months ago about the construction boom near Taiwan Semiconductor Manufacturing Co.’s planned chip plant in the southern Taiwanese city of Kaohsiung.

The agent asked if I was interested in investing in property there and hinted that there was some flexibility in prices. Her attitude was in stark contrast to our last conversation, when she said “no discount is possible” for presale high-rise apartments.

This exchange is just a small reflection of how optimism over the chip industry is starting to cool. After nearly two years of supercharged growth, chipmakers face rising concerns over inflation, slowing consumer demand and a potential recession.

Stock prices are another sign of this new gloom. TSMC’s share price has dropped about 30 per cent year to date, while top chip developers like Nvidia and MediaTek are down almost 50 per cent.

Meanwhile US memory chipmaker Micron is cautious about the outlook for the second half of 2022, while smaller peer Nanya Tech has signalled a slowdown in demand for cloud computing and servers, once its most robust segments.

Hungry for CHIPS

Against this gloomy backdrop, CEOs of major companies from Intel to TSMC and Amazon to GM are pressing the US government to pass the $52 billion CHIPS Act before the end of July, Yifan Yu with Nikkei Asia writes.

The US has been the most vocal among global economies calling for more chip manufacturing to be brought onshore. The CHIPS Act was introduced over two years ago with the aim of kick-starting investment and innovation in the domestic semiconductor industry by offering tax breaks and other incentives. But it has languished unfunded, as fraught domestic politics hinder progress.

Now, American and Asian chipmakers alike are warning that they will have to delay or scale back investment in the US unless Washington gets its act together. These include Intel and GlobalFoundries of the US and Taiwan’s GlobalWafers, the world’s third-biggest wafer material supplier.

“We have all eyes on the CHIPS Act and all the investment incentives and support related to this,” said Doris Hsu, chair and CEO of GlobalWafers. “That would really help us offset the high cost to produce in the US.”

Hopes are high that the act will pass this month, before Congress enters its month-long recess in August.

Hsu, whose company plans to build a $5bn plant in Texas, spoke for many in the industry when she explained her impatience for action: “We have promises to customers to fulfil and can’t wait forever!”

Retention trouble

TSMC has embarked on its largest recruitment drive ever to ensure it has enough engineers and technicians to keep its historic $100bn expansion plans on track. Since 2019, the world’s largest semiconductor company by market cap has increased its workforce by 27 per cent to more than 65,000 people.

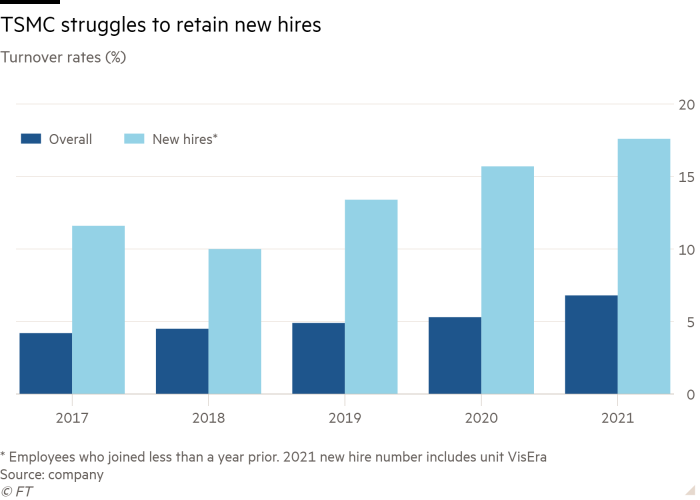

But hiring is only half the story. TSMC revealed in its latest annual ESG report that it is struggling to retain new hires as a fierce chip talent war rages in Taiwan and beyond, Nikkei Asia’s Cheng Ting-Fang and Lauly Li write. The chip titan’s turnover rate for new hires surged to 17.6 per cent in 2021, far exceeding its overall corporate turnover of 6.8 per cent. It was also a sharp spike from a new-hire turnover rate of 13.4 per cent in 2019, despite the company’s stated aim of bringing it down to 10 per cent by 2030.

Spies wanted

Chinese university students have been enticed into working for a secretive technology company accused by the US of conducting cyber espionage operations on behalf of Beijing’s intelligence agency, the Financial Times’ Eleanor Olcott and Helen Warrell write.

The FT contacted 140 foreign language graduates who appeared on a leaked list of Hainan Xiandun applicants compiled by security officials in the region, to corroborate the authenticity of the applications. The company was alleged in a 2021 US federal indictment to have been a cover for the Chinese hacking group APT40.

The students applied to Hainan Xiandun, which is based on the southern island of Hainan, after the company solicited applications on university recruitment sites without making clear the nature of the work or the potential risks involved.

A few individuals on the list shared their experience of the hiring process, which included translation tests on sensitive documents obtained from US government agencies and instructions to research individuals at Johns Hopkins University.

APT40 is known for targeting Western biomedical, robotics and maritime research institutions. Hacking on that scale requires a huge workforce of English speakers who can help identify hacking targets, cyber technicians who can access adversaries’ systems and intelligence officers to analyse the stolen material.

Even after the US sought to disrupt the group’s activities last year by indicting several figures linked to Hainan Xiandun, a second company, Hainan Tengyuan, continued to advertise for recruits to work on cyber espionage.

A deeper divide?

Beijing is proposing national technology standards that would in effect give foreign tech manufacturers a stark choice: increase local sourcing of key components for products sold in China, or else abandon the world’s biggest market, Nikkei’s Shunsuke Tabeta writes.

Office equipment like printers and multifunctional copiers would be the first products targeted under the new rules, which could come into effect as early as next year. The proposed rules, which have been under consideration since April, call for key components and parts like chips to be designed, developed and produced in China. Suppliers of critical information infrastructure, moreover, will be required to procure products that meet the national standards.

China’s move to set stricter national technology standards goes beyond an earlier focus on safeguarding security technology, a move aimed at creating a self-reliant domestic supply chain. These new rules would likely increase the market share of Chinese-made tech components, but more worryingly they point to ongoing pressure for a “decoupling” of US and China supply chains as geopolitical tensions continue to simmer.

Suggested reads

-

EV supply chain: Japan, China vie for power in lithium standards (Nikkei Asia)

-

Sequoia targets $9bn China fundraising despite tech crackdown (FT)

-

Twitter launches legal challenge to Indian government blocking orders (FT)

-

Nomura and SBI plan to launch digital token operations (Nikkei Asia)

-

Sold out: Nintendo Switch sales fall 33 per cent in Japan amid supply snag (Nikkei Asia)

-

Metaverse dating app popular with young people in China vies for HK listing (FT)

-

Philippines start-up MarCoPay gives sailors financial freedom at sea (Nikkei Asia)

-

India internet sector in fog after controversial VPN rules delayed (Nikkei Asia)

-

Japanese court ruling poised to make Big Tech open up on algorithms (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp