US steel lobby mobilises to preserve Trump’s tariffs

US president Joe Biden’s promise to end trade wars with Europe after four years of transatlantic strain under Donald Trump is running into hard opposition from the American steel industry.

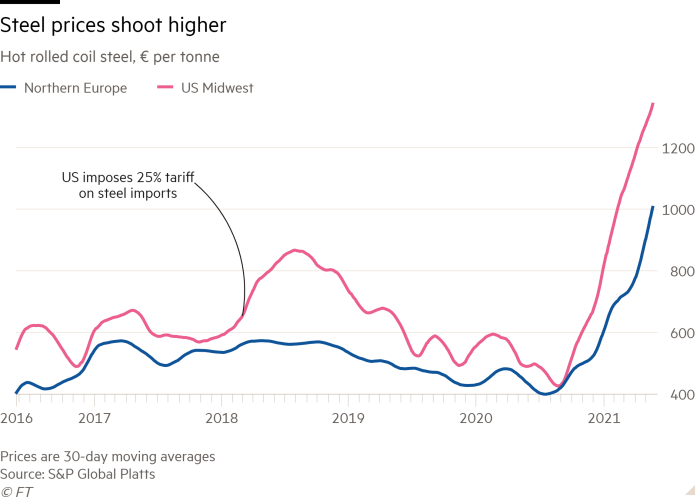

Steel mills in the US have prospered in the past year as commodity prices have surged and the industry consolidates. Another factor in their favour is the 25 per cent tariff that the Trump administration placed on imported steel in 2018.

European officials want the tariffs removed. Last week the Biden administration said it hoped to reach an agreement with the EU on the issue by the end of the year after Brussels said it would delay escalating retaliatory tariffs of at least 50 per cent on US goods including bourbon and Harley-Davidson motorcycles.

But satisfying Europe risks irking a politically powerful US steel industry with mills in states including Indiana, Ohio and Pennsylvania.

“Steel is a powerful word, it symbolises American might and it’s seen as a fundamentally American industry,” said Paul Sracic, a professor of political science at Youngstown State University in Ohio. Removing tariffs will be “politically really difficult”, he said.

Europe’s retaliatory levies were a reaction to the so-called Section 232 tariffs that the Trump administration introduced on national security grounds, which also included a 10 per cent duty on aluminium imports.

Although Brussels’ announcement last week signalled a potential detente, the US steel industry is already lobbying the president to keep the tariffs. Last week industry bodies and steel workers unions wrote to Biden to argue that removing the tariffs would “undermine the viability of the American steel industry”, which they say is threatened by state-subsidised mills in China.

Steel markets have skyrocketed, with US prices higher than similar steel in Europe. The shares of US steelmakers such as Nucor, Cleveland-Cliffs, Steel Dynamics and US Steel have more than doubled in the past year, according to S&P Global Market Intelligence.

US steelmakers argue the rally is part of a broader boom driving up prices for products including lumber, semiconductors and farm products, not Trump’s tariffs.

“We’ve gone from a situation where there was virtually zero demand, and no inventory being built up, to a situation now where the economy actually got through the pandemic better than people thought, and there was a lot of pent-up demand not only for steel, but many other commodities,” said Phil Bell of the US Steel Manufacturers Association.

Users of steel want Trump’s tariffs scrapped, however. The US Chamber of Commerce, one of the most powerful business groups in Washington, said that soaring steel prices presented serious challenges to American manufacturers that make things out of steel.

Last week about 300 smaller US businesses wrote to Biden to demand that the duties be dropped, saying that for some products American businesses were paying 40 per cent more for similar steel compared to European counterparts, and delivery times were stretching from six weeks to 20 weeks.

“Without termination of the tariffs, this situation will worsen if Washington moves forward with an infrastructure bill to invest in America, as these projects will create more strain on domestic steel and aluminium supplies, causing delays in construction and risking manufacturing jobs,” the group wrote.

Steel industry figures who support the tariffs remain open to the idea that Biden could roll them back in exchange for securing more action from Europe against Chinese steel overcapacity, coupled with new stimulus for the domestic steel industry in the form of the proposed infrastructure package.

Roy Houseman, the legislative director for the United Steelworkers union, which represents more than 850,000 workers in steel and other industries and supports the tariffs, acknowledged that Biden’s $1.7tn infrastructure proposal could boost domestic demand for steel and support the industry.

“It all depends on the size of the package and how it drives demand,” Houseman said of the infrastructure legislation, whose current form and scale faces staunch opposition from Republican lawmakers in Congress.

Biden has also moved to strengthen existing Buy American laws, which force US government agencies to procure domestically as much as possible, providing another potential benefit to the US steel industry.

Clete Willems, a former Trump administration trade official, said the Biden administration could work with Europe to strengthen monitoring of transshipment, whereby Chinese steel reaches the US via Europe and avoids import restrictions.

Instead of the Section 232 tariffs, the US could also place quotas on steel imports and threaten to reapply tariffs if there was a surge of the metal entering the US, Willems suggested.

Scott Paul, president of the Alliance for American Manufacturing, which is backed by industry and the steelworkers’ union, said that whatever solution the EU and US reach would need to continue to defend the American industry from surplus capacity in China.

“I can’t imagine a scenario under which this administration would pull the rug from underneath the steel industry in the United States,” Paul said.

Sracic, of Youngstown State University, said the calculus relied more on politics than economics, and appearing to snub American steel jobs would lose voters. “That’s why the administration has to be careful even talking about removing tariffs,” he said.

Trade Secrets

The FT has revamped Trade Secrets, its must-read daily briefing on the changing face of international trade and globalisation.

Sign up here to understand which countries, companies and technologies are shaping the new global economy.