This Week in Fintech ending on April Fool’s Day

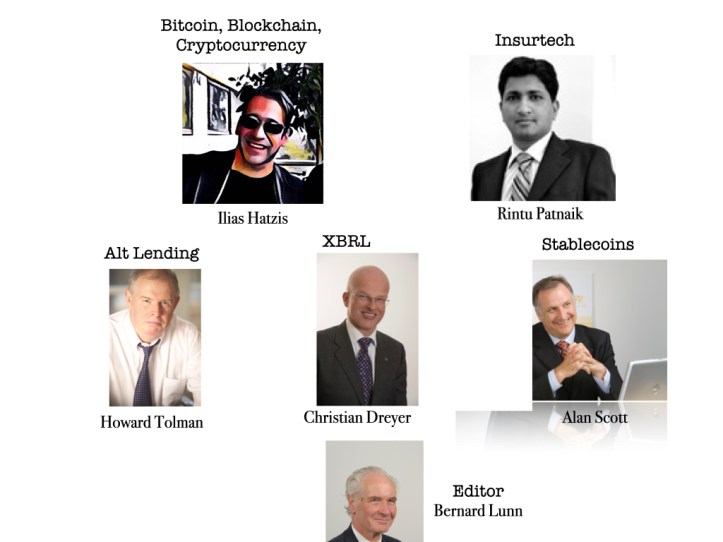

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Buy now, pay later. Better with crypto?

Shoppers have flocked to BNPL (Buy Now Pay Later) over the last couple of years as online shopping has surged amid the pandemic. While the idea is not particularly new, its rise in popularity among financial institutions, merchants, and consumers has been phenomenal. In fact, nearly half of all US consumers have made a purchase with a buy now, pay later option, according to a CreditKarma study.

Similar to credit cards, BNPL services like Affirm, Klarna, and Afterpay let consumers buy something today, then pay for it over time. But one of the biggest differences with credit cards is that many do not charge any interest fees, as long as the scheduled payments are made.

Consumers can take advantage of BNPL almost anywhere, be it a regular online store or a high-end outlet. BNPL services promise convenience and an alternative to credit with no interest or surprise fees.

During the same period, the collateralized lending space within Defi has exploded. Protocols such as AAVE and Compound have pioneered the space and solidified themselves into multibillion-dollar protocols. Combining BNPL with Defi could create a way to effectively utilize the influx of capital in Defi to service off-chain borrowers.

Editor note: Read this to understand how BNPL services could accelerate profitability using crypto.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Part 1 Global reserve currency fundamentals

Way back in 2014 (when Daily Fintech was born, Bitcoin was in a bear market (priced around $500) and the last time Putin ordered an invasion of Ukraine) I wrote My explorations down the Bitcoin rabbit hole. Although this is old analysis it is still relevant today and other people who are on the same journey of exploration may appreciate the travel tales as well as the map.

At that time, the idea that Bitcoin could be seriously considered as a global reserve currency seemed like the wilder fringes of speculation. In 2022 with a major new war in Ukraine and persistently high inflation, the idea does not seem so crazy.

Editor note: As Lenin famously said, there are decades when nothing happens and weeks when decades happen

——————————————-

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: IoT device innovator makes homes smarter, goes public

Special purpose acquisition company (SPAC) Spinnaker Acquisitions completed a reverse merger with LeakBot, UK based B2B Insurtech, to create Ondo InsurTech. This new entity will be the first Insurtech to go public in Britain. Ondo brought in about $4.5 million from investors, grossing a market capitalization of about $10.8 million. It will use the fresh capital for partner development, onboarding and improving its delivery and IT systems.

Editor note: This will be a very good test of whether public markets, facing a lot of macro headwinds can be used to fund innovation.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

And in late breaking news today, 1 BTC costs $1m and Michael Saylor says it won’t go any higher.

——————————————-

This Week in Fintech is now outside our paywall. You can read anonymously on our site or subscribe by email (all we need is one of your email addresses). Both delivery options are free.