This Week in Fintech ending 25 March 2022

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

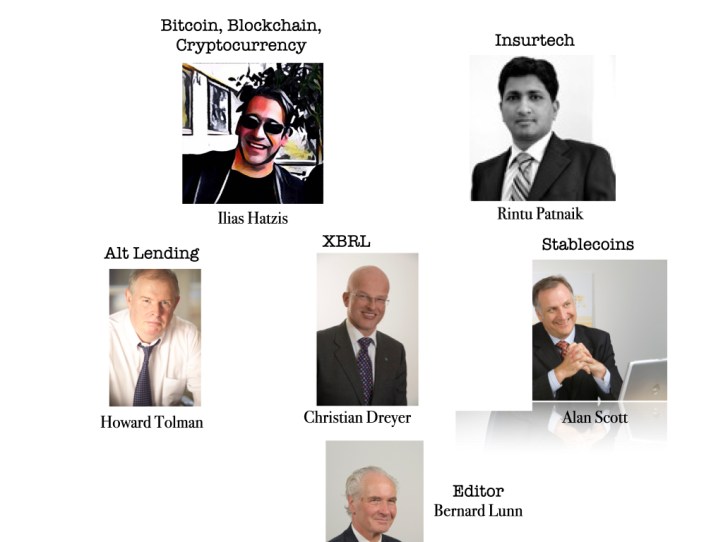

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Every bank will become a bitcoin bank

For years banks around the world worried that regulating cryptocurrencies would legitimize them and pose a threat to the existing financial system. So they tried to kill bitcoin calling it a fraud, a Ponzi scheme, a vehicle for money launderers and terrorists to fund their activities. While in September 2017, Jamie Dimon, JPMorgan’s CEO, called bitcoin a fraud, JPMorgan recently became the world’s first bank to set up shop in the metaverse, featuring in its lounge a digital image of Dimon 😊 Their efforts to kill bitcoin and crypto failed and now they have no choice but to embrace them. The banking industry is racing to catch up and compete in this new world and profit from it. But why the change of heart? The answer is simple: customers want crypto.

Editor note: Banks have a tough dilemma. Customers want Bitcoin but governments who license banks do not want Bitcoin.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote:Fintech Macro Part 4. CAC/LTV is single metric to evaluate both banks & Fintech startups

CAC/LTV can be used to do comparables analysis across both bank incumbents and Fintech upstarts.

A business with low CAC and high LTV should be worth a lot and vice versa, regardless of the label. Customer Acquisition Cost (CAC) on its own is the province of Sales and Marketing departments, armed with CRM and Marketing Automation systems.

Editor note: CAC/LTV is how your acquirer will be evaluating startups, so if you want your startup to exit for a lot of money, make sure these metrics look good.

——————————————-

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: Web3.0 in Insurance: Frontrunners & Mainstream

Insurance business models are beset with high operating costs, opaqueness and information asymmetry. With the advent of Web3, smart contracts, and decentralized autonomous organizations (DAOs), newer ways of transferring risk are coming to market. The use of blockchain technology within insurance is proving to reduce costs and improve end-user experience.

This final part, a continuation from the previous post, describes Web3 insurance products, including insurtechs and incumbents who are jumping in.

Roughly a third of insurance premiums are typically attributed to frictional costs. Around two-thirds are returned to customers as claims with the balance adding to distribution and operational expenses. Blockchain technology is expected to halve frictional costs, from administrative savings and reduced regulatory costs.

Editor note: Read this to understand what Insurance firms are doing to leverage Web 3 blockchain to improve efficiency and customer experience.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

This Week in Fintech is now outside our paywall. You can read anonymously on our site or subscribe by email (all we need is one of your email addresses). Both delivery options are free.