This Week in Fintech ending 24 December

Enjoy Xmas all who celebrate that event.

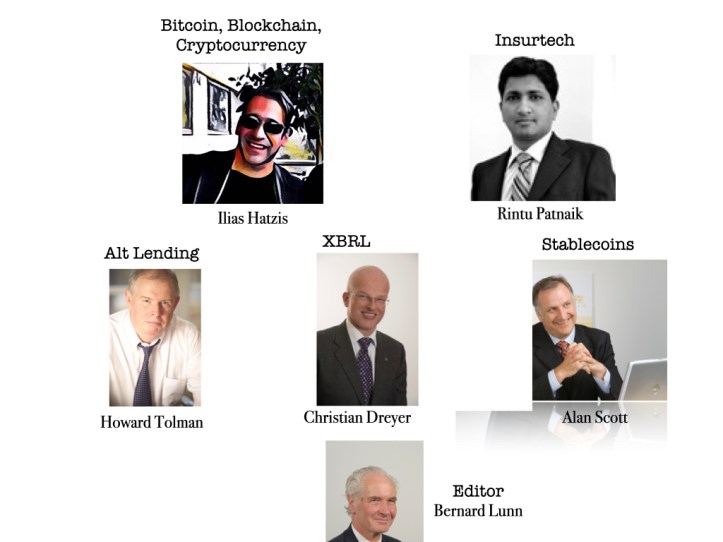

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote What’s ahead in 2022 for cryptocurrencies?

This year the ultra-rich got even richer. Elon Musk saw his fortune grow by $194 billion during the COVID-19 pandemic, followed by Jeff Bezos who saw his fortune increase by $85 billion. The world’s economic powers made the rich even richer, and the poor even poorer. To explain why this happened we need to look at the Cantillon Effect. The basic theory of the Cantillon Effect refers to the change in relative prices resulting from a change in money that’s in circulation. Cantillon explained that the first ones to receive the newly created money see their wealth rise, whereas the last ones to receive the newly created money see their purchasing power decline because inflation hits. In simple English when a state prints a lot of money, the biggest share of the wealth goes to those at the very top. Bitcoin and decentralization constitute the perfect antidote. In a bitcoin world, rather than being rewarded for privilege, status, and geography, only those living closer to the truth can reap the fruits of value creation. This past year has been a groundbreaking year for bitcoin and the cryptocurrency industry everywhere across the planet. There are so many examples of how the market for cryptocurrencies has expanded just in the last year. What’s ahead in 2022 for cryptocurrencies?

Editor note: Ilias offers a good summary of the current state of play in the crypto world.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Bitcoin in El Salvador Part 3. Voters call the shots with regulators leading to jurisdictional competition

El Salvador’s moves in bitcoin align to the main job job of an economy – to put money in the pockets of the people – in 3 ways:

- Tourism money. Bitcorati (people who made money from Bitcoin) want to have some fun when not talking crypto innovation and El Salvador has lots of fun things to do (like surfing on Bitcoin beach).

- Innovation money. Innovation capital (cash and IP) will head down to El Salvador because it has real value as a jurisdiction and laboratory for consumer crypto innovation using Lightning Network and because El Salvador is physically easy to get to from the American West Coast with direct flights from San Francisco. Oh and there are lots of fun things for nerds to do when not talking crypto innovation.

- Investor money. Bitcoin City, powered by geothermal energy and a Bitcoin Bond and super low taxes will bring in money.

Editor note: Your editor still believes in the old fashioned idea that in a democracy, the voters (people/citzeens) call the shots and that freedom and democracy are essential for innovation.

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: M&A braces for big moves in the New Year

2021 has been momentous for deals. From AT&T’s media businesses merger with Discovery, Kansas City Southern railroad’s takeover or Square acquiring BNPL company Afterpay, global deals are on a roll. Transactions are expected to top $5 trillion this year. All this, while the pandemic is rising again, the global economy is still flaky, and developed economies are toughening their antitrust stance. The buying and selling frenzy are upending conventional wisdom that conducive state of affairs require stable business environments. Companies seem gung-ho about capitalizing on the uncertainty, momentum is far from slowing down.

Editor note: Read this to understand what will be driving Insurtech M&A activity in 2022.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

Daily Fintech is taking a break next week to celebrate Xmas and Gregorian New Year.

To continue receiving ‘This Week in Fintech’, the weekly recap of our articles, you will need to fill this form to give us consent to send this to you. Please note that Daily Fintech requires your organizational email address (e.g. corporate, educational or government) and your LinkedIn URL. This information is required for subscribers who want ‘This Week in Fintech’ for free. If you prefer to not provide this information, you can still receive all our content by becoming a paying member.