This Week in Fintech ending 1st October

Yes, we are in the final quarter of 2021, fall/autumn fashions and weather and the last 3 months for businesses to show results and our experts have been working hard to bring you their insights based on their experience as investors, entrepreneurs & executives.

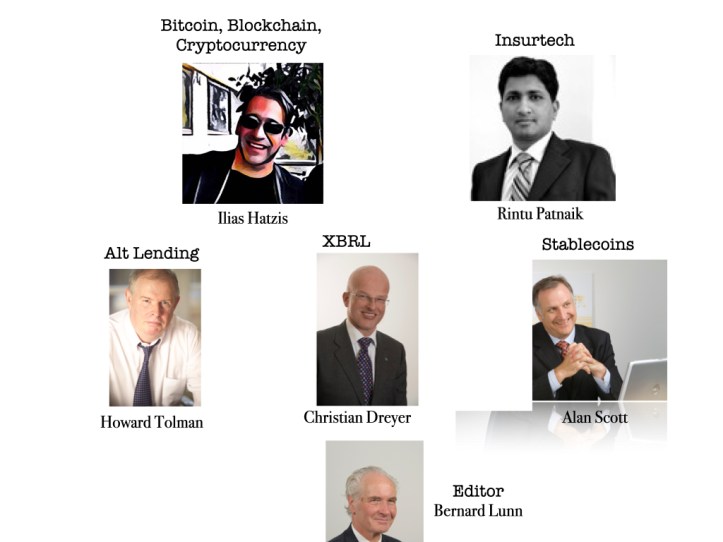

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Evergrande is the trigger to a crypto economy

China has banned Bitcoin more times than I can remember. On Friday, China declared that all crypto transactions are illegal driving a sell-off of Bitcoin, Ethereum, and other cryptocurrencies. The market value of the world’s cryptocurrencies tanked to a low of about $1.8 trillion, falling roughly 9% and losing $188 billion in value within just three hours of China’s announcement, according to CoinMarketCap.

Editor note: China is the poster child for centralized control, so it’s leaders are bound to try to stop Bitcoin but honey badger don’t care!

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Part 4 Place your bets on this behemoth battle

It is easy to place your bets as all three companies are publicly traded. Square is part of the Fintech 50 Index. Facebook and Twitter are big media businesses.

Bias disclosure. While I have no commercial stake at time of writing I do have two biases.

Editor note: Square is a great company, possibly overvalued and too exposed to small business that got hammered by the pandemic.

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote:Risk Exchange Platforms for Reinsurance Gain Prominence

The future of reinsurance (RI) markets is being reshaped by new technology, alternative capital and reinsurers bundling value-added services with reinsurance. These forces are leading to new trends, in a backdrop of changing RI buying patterns, emerging risks and the realities of ever changing regulation. Placement processes have evolved at a slow pace while acquisition costs are on the rise. The reinsurance placement process includes discovering RI prices, agreeing to contract terms and conditions, and allocating limits among several reinsurers. It is a complex, slow and expensive process that involves face-to-face meetings with numerous handovers. The ensuing inefficiency and opacity makes this market ripe for more automation.

Editor note: Rintu shines a light on part of the Insurance business that is very important but that few understand.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

To continue receiving ‘This Week in Fintech’, the weekly recap of our articles, you will need to fill this form to give us consent to send this to you. Please note that Daily Fintech requires your organizational email address (e.g. corporate, educational or government) and your LinkedIn URL. This information is required for subscribers who want ‘This Week in Fintech’ for free. If you prefer to not provide this information, you can still receive all our content by becoming a paying member.