This Week in Fintech ending 18 March 2022

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

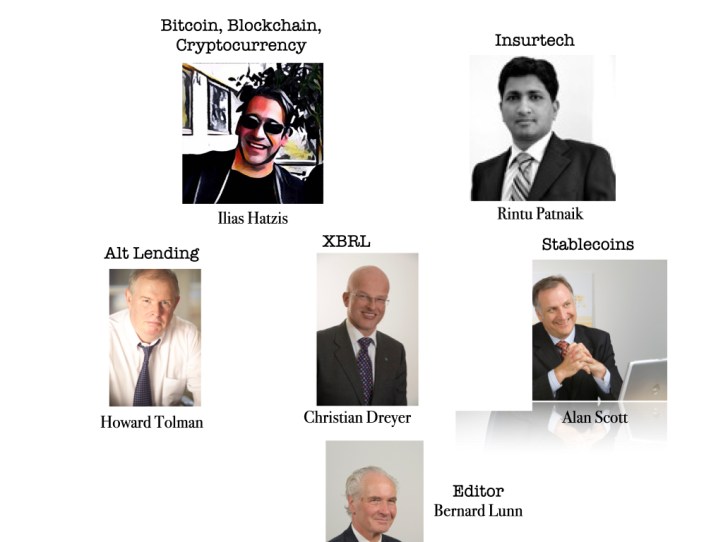

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Forget cash. Pay me in bitcoin

In November, when bitcoin and Ethereum reached all-time highs, famous athletes, politicians, and regular people raced to join in on the excitement by announcing that they would convert a portion of their salaries into cryptocurrency. Their argument was that if you get paid in US dollars, as inflation increases, the value of your paycheck decreases.

Editor note: When people choose to get paid in Bitcoin and pay in Bitcoin, everything changes!

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Fintech Macro Part 3 Bitcoin is bad for traditional finance

I could have said Crypto is bad for traditional finance but – disclosure – I am a Bitcoin maximalist and own some.

Bitcoin is part of a Web3 vision of an Internet that is not controlled by a few big centralised players such as Google, Facebook and Amazon ie the Web2 we use every day.

This makes Bitcoin bad for finance in whatever form it appears – tech or traditional. A decentralized value transfer network is deeply disruptive to the finance ambitions of centralized search engines and social networks as well as legacy banks.

Editor note: Some subjects are too complex for our short attention spans, so we do 4 posts one week apart, each one short enough not to lose your attention but in aggregate doing justice to the complexity of the subject. Stay tuned by subscribing.

——————————————-

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: Web3.0 in insurance Part 1: Futuristic or panacea?

Web 3.0 is founded on a substrate of edge computing, machine learning and decentralized data architecture. This decentralization of data hinges on blockchain technology to create an open, secure and transparent workscape, enabling participants on the network to interact sans intermediaries, while ensuring that data ownership resides with users. The expectation for Web3 is to drive efficiencies in the financial system and deliver a smarter UX.

Web3 is already transforming the way financial and tech companies interact with customers.

Editor note: Rintu looks at the opportunities and pitfalls of Web3 for Insurance. Stay tuned for Part 2 next week.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

This Week in Fintech is now outside our paywall. You can read anonymously on our site or subscribe by email (all we need is one of your email addresses). Both delivery options are free.