This Week in Fintech ending 18 February 2022

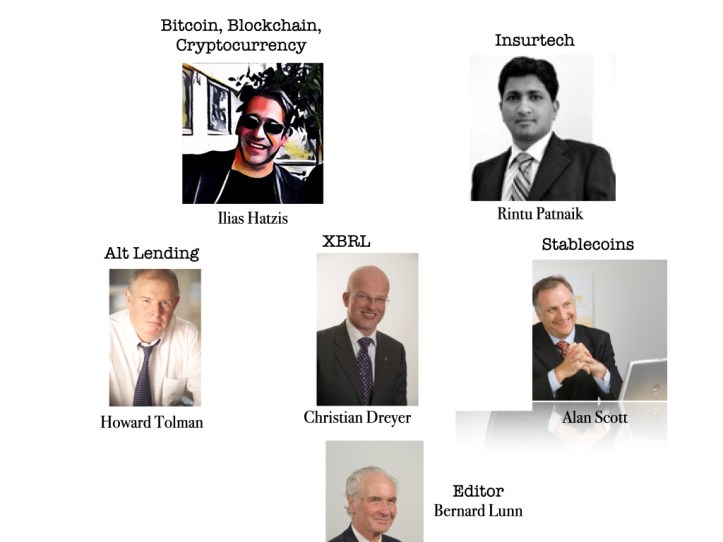

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Big crypto eats little crypto

Earlier today when I was searching on Google for crypto mergers and acquisitions over the last thirty days, I found stories like “ConsenSys acquires MyCrypto, plans to merge it with Metamask”, “OpenSea buys DeFi wallet startup Dharma Labs”, “Coinbase buys FairX to launch crypto derivatives”.

PwC reported in early February that crypto mergers and acquisition values went up 5,000% in 2021, with the average transaction size tripling in value, from $52.7 million to $179.7 million. The consolidation of cryptocurrency-related companies surged massively in 2021 and dealmaking momentum is expected to continue in the new year.

Editor note: Read this to understand the consolidation phase in crypto as risk-on prices come down, bringing M&A deals to closure.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Web3 Part 3 exchanging value (not just content) online is a game changer

One reason why Web3 has some negative chatter is that it is being used to hype some crypto projects. The implied correlation is Web3 is good so crypto project X is good.

I am NOT promoting any crypto projects, but I think that Web3 based on decentralised and permissionless exchange of value is real and not hype.

Editor note: Hype is useful for selling something today, real value is useful for long term value creation.

——————————————-

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote:Insurance Forays & Business Models of Neobanks

Since the first wave of challenger banks arrived around 2015 with basic account offerings, the biggest players branched out into lending, stock trading, savings, and junior accounts. Few took decisive steps into the insurance market. As they sought to gain a competitive advantage, leading neobanks have since expanded their product offerings with insurance and boosted revenues with payment protection.

Neobanks monetize through paid subscriptions similar to traditional SaaS, that generate predictable income streams. Revolut, for instance, offers three plans – standard, premium, and metal. Interchange revenue is money that a card issuer receives when swiping its card. It is paid by the merchant through payment processing fees. The average interchange rate is around 1.25% in Europe. Banking-as-a-Service solutions often take a cut on those percentages.

Editor note: Banking and Insurance work well together and this post looks at how modern digital Neobanks are building this synergy.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

This Week in Fintech is now outside our paywall. You can read anonymously on our site or subscribe by email (all we need is one of your email addresses). Both delivery options are free.