This Week in Fintech ending 16 April 2021

This week, the week Coinbase went public, our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

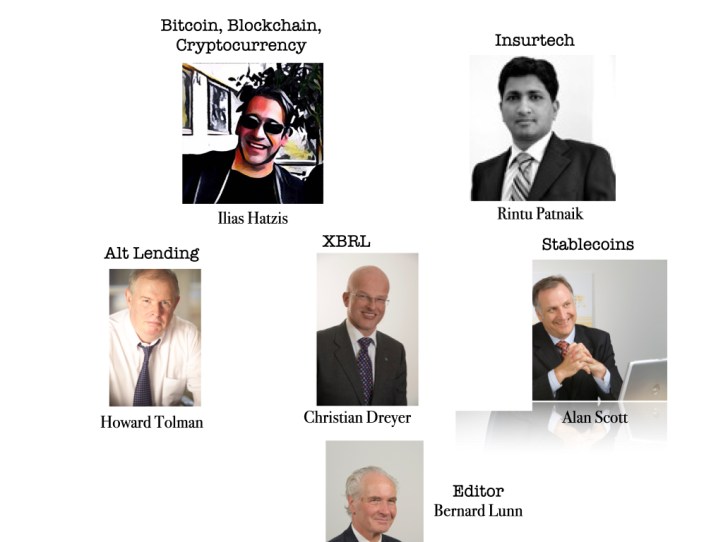

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio, a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto without private keys or passwords.) @iliashatzis wrote Taking a dive into the bitcoin pool this week

Scanning the news this weekend there were plenty of interesting stories and we’ll be discussing three: central bank digital currencies, privacy and payments. Checking the Coinbase mobile app yesterday, bitcoin broke the $60k mark, reaching on Saturday $60,658. This is going to be a big week for crypto. On Wednesday, April 14, Coinbase, the world’s most popular cryptocurrency exchange, will make its debut on Nasdaq. This is a major step to legitimacy, as Coinbase will be the first cryptocurrency company to be listed on the public markets. They also reported their first quarter results and while the results are preliminary and unaudited, they are impressive. In Q1 2021, their revenue jumped $1.8 billion from $190.6 million in the same quarter a year earlier. Net income grew to between $730 million and $800 million from $31.9 million a year ago. Coinbase said it has 56 million verified users. Speaking today a friend and ex-banker that is heavily invested in bitcoin, he told me that he was also planning on buying Coinbase shares. Coinbase is a great opportunity for anyone into crypto to further diversify their portfolio. Crypto has reached a tipping point that no one can afford to ignore. China has been testing the digital yuan and this month it will be expanding its tests. A lawyer in Argentina is suing the Central bank, trying to prevent it from acquiring data on crypto users. PayPal announced the next phase in its bitcoin rollout, giving users the option to pay vendors during checkout with crypto, instead of a card or other payment method.

Editor note: Read this to find out what mattered in crypto land in the week before Coinbase goes public

——————————————-

Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote:4-part series on Digital Identity. Part 2 = The bank says this is about CYA, KYC, KYT and CAC/LTV.

Starting with the rude stuff, CYA = Cover Your Ass. Clean part of headline: KYC = Know Your Customer, KYT = Know Your Transaction, CAC = Customer Acquisition Cost, LTV = Life Time Value. Read on, all will be revealed.

Editor note: Read this to understand why Banks spend so much time and money on Digital Identity.

Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Coinbase joins the Fintech 50 Index.

Editor note: By the time you read this Mr. Market will have told us where COIN will rank on market cap out of 50 stocks in the Fintech 50 Index.

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote Stablecoin News for the week ending Wednesday 14th April.

This weekly snapshot is the news that matters in the Stablecoin market.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: Taking stock of emerging risks in the digital landscape

The contours of risk are changing, becoming more connected and interdependent. There are several examples, but an apt one is the current pandemic that exemplifies how risks are becoming global, complex and difficult to address. Recent research reveals that 73% of general public and 83% of risk experts believe that populations world over are more vulnerable today than five years ago. Climate change, known to induce extreme weather events, coupled with rising intensity and frequency of hurricanes, wildfires and flooding has caused large insured and uninsured losses. But, after decades of experience, the insurance industry has a better understanding of the principles, associated risks, perils, hazards to tackle the consequences of such natural disasters, though it still needs to grapple with the scale involved. The same cannot be said of digital technology risks and attendant opportunities, threats, perils and hazards. For instance, the industry comes up short on appreciating the risks with artificial intelligence and related impacts.

Editor note: How do you assess complex system risks? Learn some complexity science and don’t rely on linear models alone!

Christian Dreyer @x3er, our Swiss based CFA who focusses on how XBRL changes our world wrote his weekly snapshot of the news that matters in the XBRL market.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London. wrote his weekly snapshot of the news that matters in the Alt Lending market.

——————————————-

Your Editor is Bernard Lunn. He is also the CEO of Daily Fintech and author of The Blockchain Economy and occasional opinion columnist.

To continue receiving ‘This Week in Fintech’, the weekly recap of our articles, you will need to fill this form to give us consent to send this to you. Please note that Daily Fintech requires your organizational email address (e.g. corporate, educational or government) and your LinkedIn URL. This information is required for subscribers who want ‘This Week in Fintech’ for free. If you prefer to not provide this information, you can still receive all our content by becoming a paying member.