This Week in Fintech ending 11 March 2022

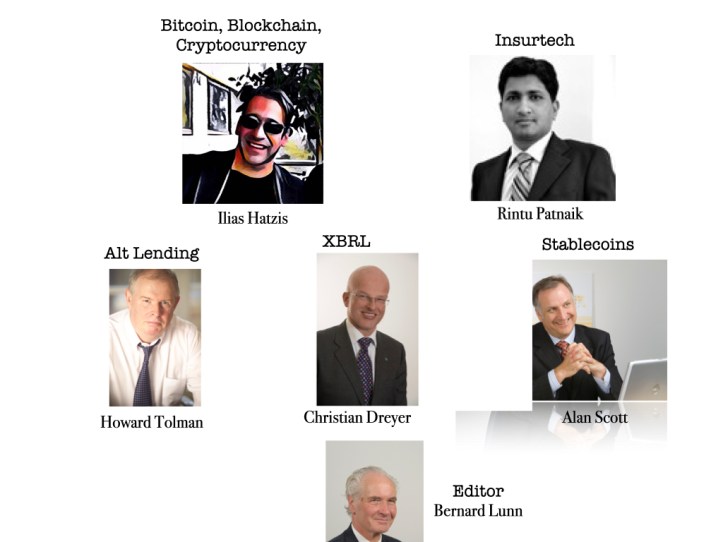

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Crypto is inching its way into payments

Earlier this year, Visa revealed during its last earnings call that consumers made $2.5 billion worth of transactions using their crypto-linked cards, during its fiscal first quarter of 2022. Back in July, Visa reported crypto-linked card usage reached $1 billion for the first six months of 2021. The 2022 Q1 numbers represent a 70% increase compared to all of 2021. People are using crypto-linked cards to make everyday purchases and pay for retail goods and services, restaurants, hotel accommodations, and airline tickets. The transaction growth shows that the adoption of crypto-linked cards is spreading rapidly and signals that consumers see the utility of having crypto-linked cards connected to their digital assets on crypto platforms. Visa has already signed up crypto wallet partners like Coinbase, BlockFi, and Circle and its network has reached more than 60 partners. What’s more important to note is that crypto-linked cards don’t require coffee shops, grocery stores, or restaurants to directly accept cryptocurrencies at the checkout. There is no complexity on the merchant side to accept crypto or worrying about volatility.

Editor note: Ilias makes a compelling case for how crypto will build a second leg as a payments tool.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote:Fintech Macro Part 2. Neobank consolidation phase will create a few huge winners

During the Cambrian explosion phase, lots of Neobanks were funded. It was a period of high excitement, full of hopes and dreams.

Cambrian explosion is usually followed by consolidation.

Editor note: Which Neobanks will emerge as winners from the consolidation phase?

——————————————-

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: Trōv’s many firsts, now in Travelers’ arsenal

In 2020, Trōv developed the Embedded Insurance Platform (EIP) and launched it in June 2021. The EIP was purposed to aid the distribution of P&C insurance products by companies with digital footprints. Trōv saw the latent potential in embedded insurance and tapped the market need of digital consumer brands that sought new insurance offerings. Recently, Travelers acquired Trōv and announced the latter’s embedded platform will be folded into Travelers’ personal lines.

Editor note: We are now in the consolidation phase of the market where companies use M&A to drive growth.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

This Week in Fintech is now outside our paywall. You can read anonymously on our site or subscribe by email (all we need is one of your email addresses). Both delivery options are free.