This Week in Fintech ending 10 December

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

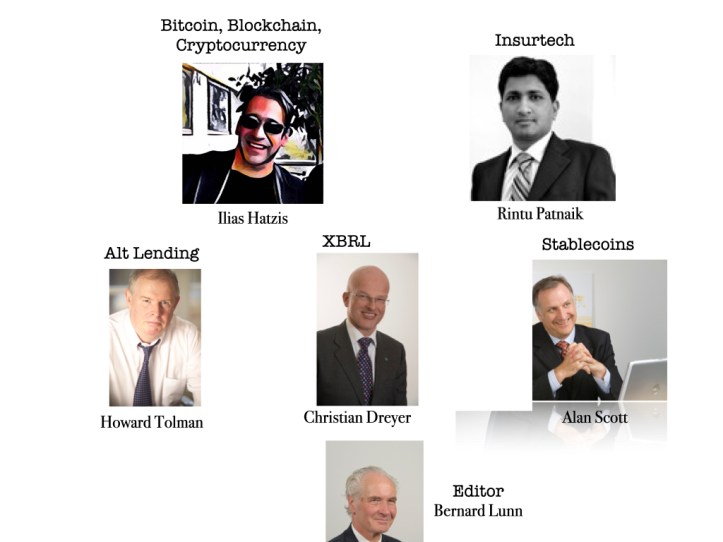

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote Crypto investing your first $1,000 in 2022?

In the past couple of days, the entire crypto market has taken a pounding. The price of bitcoin dropped on the morning of Saturday, plunging by more than 20% to $42,000 with Ether following suit, falling as low as $3,500. The drop has been brewing for a while now and gathered steam this week after the coming out of the latest Covid-19 variant, Omicron, and the comments by the Federal Reserve that monetary support for markets is soon going away. The Fed’s move would mean less money flowing into bonds, which would lower bond prices and lift their yields, making them less attractive to own. Some are using this drop in crypto prices as an opportunity to “buy the dip.” The president of El Salvador, Nayib Bukele, announced his country had “bought the dip”, buying another 150 BTC at a price just over $48,000. Today, bitcoin’s price bounced back but remained under $50,000. Since the beginning of 2021 bitcoin is up 63%. What are you planning on doing in 2022? Will you be buying crypto?

Editor note: The Institutional phase of the market puts BTC in the risk on bucket ie sell. Next phase will have a different narrative which will feature countries like El Salvador.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Bitcoin in El Salvador Part 1 First the Rest then the West

El Salvador is getting a lot of attention for a little known country whose GDP in 2020 was only $24.64 bn (0.02% of the world economy).

After El Salvador announced the stunning move to make Bitcoin legal tender on 25 June 2021, Daily Fintech opined 10 reasons El Salvador President made the right call on Bitcoin at the right time.

In this 4 parter we dig deeper as big powerful people and institutions attack El Salvador verbally. The stakes are very high for two reasons.

Editor note: The geopolitics of Bitcoin as US faces the end of global reserve currency is very interesting.

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India is not available this week, so Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote: Windsock Score for Lemonade ($LMND), a member of the Fintech 50 Index of publicly traded stocks.

Windsock Score is our qualitative rating of companies in the Fintech 50 Index. We expect investors to use this together with quantitive analysis.

We call it Windsock because we are looking for both headwinds (strategic obstacles to growth) and tailwinds (strategically well positioned for growth).

We start with Lemonade ($LMND), the only member of the Fintech 50 Index of publicly traded stocks to focus exclusively on Insurance.

Editor note: Lemonade is certainly valued like a growth stock.To find out how fast Lemonade is actually growing, investors should do quantitive analysis of quarter to quarter revenue momentum.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

To continue receiving ‘This Week in Fintech’, the weekly recap of our articles, you will need to fill this form to give us consent to send this to you. Please note that Daily Fintech requires your organizational email address (e.g. corporate, educational or government) and your LinkedIn URL. This information is required for subscribers who want ‘This Week in Fintech’ for free. If you prefer to not provide this information, you can still receive all our content by becoming a paying member.