This Week in Fintech ended 5 November 2021.

Yes, it is already November!

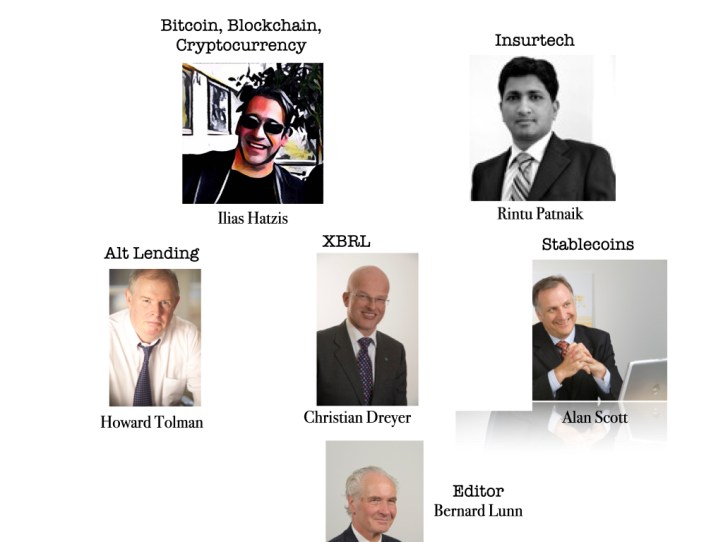

This week our experts brought you the following insights based on their experience as investors, entrepreneurs & executives.

Monday Ilias Hatzis our Greece-based crypto entrepreneur (Founder & CEO at Kryptonio a “keyless” non-custodial bitcoin and cryptocurrency wallet, that lets users manage bitcoin and crypto, without private keys or passwords and Weekly Columnist at Daily Fintech) @iliashatzis wrote A “Meta” World Built on Blockchain

If you weren’t familiar with the term “metaverse”, I am sure you are now after Facebook announced that it’s changing its name to “Meta”. On Thursday, Mark Zuckerberg announced that Facebook’s parent company was changing its name to Meta to emphasize its focus on metaverse. Metaverse is defined slightly differently by futurists, but at its core, the idea is basically the same: the metaverse is where the physical and digital worlds come together, and digital representations of people can interact with each other for work or play. Some, including Mark Zuckerberg, take the idea even further and add a virtual reality element to the metaverse, where two people on opposite sides of the world meet in a virtual room and interact. The metaverse represents a huge financial opportunity, as digital objects will have to be represented, ownable, sellable, and transferable within the metaverse. Blockchain and NFTs grant holders true ownership over digital items, and have already become a critical building block for emerging metaverses.

Editor note: Facebook is either losing the plot or playing a brilliant long game. After reading Ilias’s post today I am more convinced it is the latter.

——————————————-

Tuesday Bernard Lunn, CEO of Daily Fintech and author of The Blockchain Economy wrote:Part 1 Copy trading may disrupt fund management.

The idea – like most disruption – is simple. You follow somebody’s trades and give them a share of the profits. This enables a new breed of fund managers to invest first then gather assets later, which is the exact opposite of how it works today. Today a fund manager startup first gathers assets from limited partner investors and then invests those assets. This model is broken for both the limited partner investor and the fund manager startup. The fund manager startup has a huge hurdle to overcome which is proving how good they are at investing before they have made any investments. This favours the big incumbents, so that the limited partner investor is faced with a bad choice

Editor note: November’s 4-parter is introduced today.

Wednesday Alan Scott Managing Director EMEA at 24 Exchange @Alan_SmartMoney wrote his weekly roundup of Stablecoin news.

——————————————-

Thursday

Rintu Patnaik, an Insurtech expert based in India, wrote: Tesla Scores with Safety Program – Driving Behavior Determines Premium

During its quarterly earnings call, Tesla divulged the launch of its telematics insurance in Texas. Tesla Insurance rolled out a Safety Score program, with plans to actively track driver behavior to presage the likelihood of a collision. The program will be fine-tuned as they receive more data, ostensibly setting them apart from competition in the growing telematics-based insurance. Tesla Insurance was first offered in California last year. However, the Safety Score feature will only be used in the Lonestar State, making the coverage unlike that in California, where extant laws have shackled its technology.

Editor note: This is great news for Tesla bulls who see the company as a technology not a car company, driven by data network effects.

Christian Dreyer @x3er, the Swiss based CFA who focusses on how XBRL changes our world wrote his weekly roundup of XBRL news.

——————————————-

Friday Howard Tolman, a well-known banker, technologist and entrepreneur in London, wrote his weekly roundup of Alt Lending news.

——————————————-

To continue receiving ‘This Week in Fintech’, the weekly recap of our articles, you will need to fill this form to give us consent to send this to you. Please note that Daily Fintech requires your organizational email address (e.g. corporate, educational or government) and your LinkedIn URL. This information is required for subscribers who want ‘This Week in Fintech’ for free. If you prefer to not provide this information, you can still receive all our content by becoming a paying member.