Telecom Italia deal has added fibre

This article is an on-site version of our #techFT newsletter. Sign up here to get the complete newsletter sent straight to your inbox every weekday

While the UK may have clear and strong reasons why Arm, the global leader in chip design, should not fall into American hands, the Italian government’s position on Telecom Italia succumbing to a bid from a US private equity group seems more equivocal.

KKR launched a more than €33bn offer at the weekend to take TIM private, in what would be one of the largest private equity buyouts of a European company in history. It already holds a 37.5 per cent stake in Telecom Italia’s FiberCop broadband operation, but this is a full offer for the entire company.

TIM has been a basket case among European telcos in recent years. As Lex points out, only around a quarter of Italians have access to high-speed broadband, compared to 60 per cent of households in the EU as a whole.

KKR’s involvement (it also owns UK fibre broadband provider Hyperoptic) could accelerate fibre rollout and possibly overcome the Italian government‘s traditional habit of using its golden share to put the kibosh on any decisive ownership deals.

The prospective transaction could still be torpedoed by other vested interests, principally Vivendi’s, with its 24 per cent stake in TIM, but KKR’s move seems well-timed in the context of the shake-up that is needed to drive fibre broadband rollout.

It has been a busy couple of days for telecoms M&A. Swedish network equipment provider Ericsson expanded its services offering on Monday, announcing it would pay $6.2bn in cash for internet telephony group Vonage, in its biggest-ever acquisition.

In Asia, Thai conglomerate Charoen Pokphand and Norway’s Telenor said they would merge their telecoms units in Thailand, in a deal that will create the kingdom’s dominant provider worth more than $8.6bn.

The Internet of (Five) Things

1. El Salvador plans ‘bitcoin city’ powered by volcano

President Nayib Bukele has said the Central American country plans to build a volcano-powered “bitcoin city” financed partly by an issue of $1bn in sovereign bonds backed by the cryptocurrency. We’ve also been investigating the rise of Crypto.com and, in case you missed it, Lucy Kellaway looked at crypto in the classroom in FT Weekend. Martha Muir reports on where crypto mining machines have ended up after China’s ban on the practice.

2. Paytm down 37% on IPO price

Shares in the recently listed financial services company Paytm plunged for the second day running as traders and bankers blamed one of India’s worst market debuts on an overly ambitious valuation target. The stock of Paytm, which is backed by Japan’s SoftBank, China’s Ant Group, and Alibaba, closed 27 per cent lower following its listing last Thursday and fell another 13 per cent on Monday after a market holiday on Friday.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

3. Roblox hits Chinese wall

In July, online gaming company Roblox hired dancers in cosplay outfits to perform at its Shanghai opening ceremony, marking the start of its much-vaunted attempt to crack the Chinese market. At the time, the company proclaimed it would provide a “hyper-digital” and “boundless world” for its new users. Four months on, Roblox is struggling to make a dent in China, in the face of regulatory barriers and stiff competition, reports Eleanor Olcott.

4. Uber Eats adds weed to menu

Uber is adding cannabis to the list of items that can be ordered through its app, though for now it will be pick-up only, and only for customers in Ontario, Canada. It is the first time the rideshare and delivery company has offered direct access to buying the drug, and comes as it continues to push for looser regulations in the US.

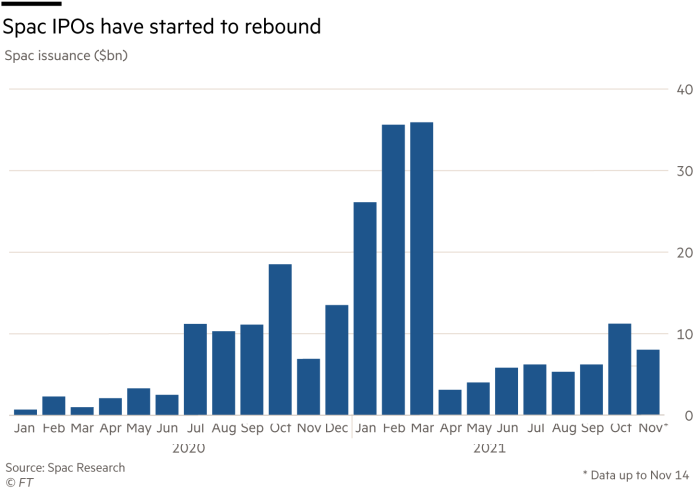

5. Life in the old Spac yet

Much loved by tech start-ups, blank-cheque Spac vehicles are making a comeback, according to The Big Read. Supporters hope that the new signs of life signal this route to public markets is maturing.

Tech week ahead

Monday: Elizabeth Holmes, the Theranos founder accused by US prosecutors of defrauding hundreds of millions of dollars from investors, is expected to testify in her own criminal trial. The Zoom video conferencing platform reports numbers for the third quarter, as it wrestles with the need to broaden its scope as staff return to the workplace and become less reliant on screen-based meetings. US financial software maker Intuit releases results for the first quarter.

Tuesday: Chinese handset and general gadget maker Xiaomi reports earnings, as does ByteDance rival Kuaishou. In the US, PC makers Dell and HP Inc have quarterly results.

Friday: Black Friday always eclipses Cyber Monday online, but a major strike is planned by a group calling itself “Make Amazon Pay”. It has the backing of 70 trade unions, who say they are setting up a number of protests at different Amazon sites.

Tech tools — Blood-sugar tracking buzz

Continuous glucose monitors (CGMs), commonly used by diabetics, track glucose rates in real time via a microneedle “installed” into the upper arm. A constellation of start-ups has devised apps that pair with these CGMs, reports Jamie Waters. These companies are positioning glucose levels as a new measure by which to guide changes in our diets, so — they promise — we can become our sharpest, most energetic selves. Read more