Tech stocks lead global sell-off as inflation worries flare up

Stock markets dropped in Europe and Asia following a slide on Wall Street, with technology shares sustaining a fresh blow from concerns that rising inflation will prompt central banks to tighten monetary policy.

Europe’s Stoxx 600 index dropped 2 per cent in morning dealings, with markets in Germany and France down by a similar margin. London’s FTSE 100 fell by 2.3 per cent. The falls came after America’s technology-heavy Nasdaq Composite declined 2.6 per cent on Monday.

Technology shares endured the heaviest selling in Europe on Tuesday, with the Stoxx 600 tech index sliding 2.3 per cent lower. Every other major industry group was also lower on the day, according to Refinitiv data.

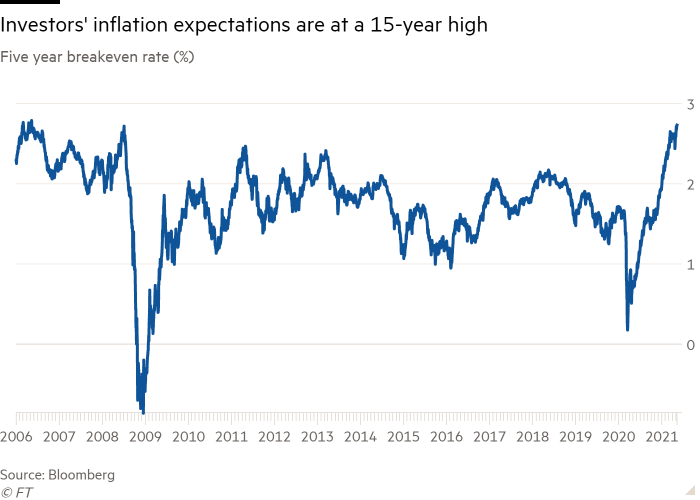

Markets are on edge ahead of new inflation data out of the US on Wednesday, which investors worry is running hot — potentially forcing the Federal Reserve to rein in its ultra supportive monetary policies despite assurances from policymakers that they are willing to tolerate short bursts of higher prices in order to support the economic recovery.

The data are expected to show consumer prices rose by 3.6 per cent in April compared with the same time last year, and 0.2 per cent compared with March 2021. A “core” index that excludes volatile food and energy prices is forecast to rise 0.3 per cent from the previous month. Citigroup economists expect rising used car, transportation and hotel prices to push up the core index.

Data on Tuesday showed that Chinese factory gate prices, an indicator of what domestic consumers and western importers will pay for goods, rose to a three-year high of 6.8 per cent last month, year on year.

Hong Kong’s Hang Seng closed more than 2 per cent lower and Japan’s Nikkei 225 ended the Tokyo trading session down more than 3 per cent.

Inflation not only raises the chances of central banks withdrawing support for markets. It also erodes the returns on fixed-income securities such as government bonds, causing their prices to fall and yields to rise. The yield on the US Treasury bond informs how investors value the future cash flows from equities. Analysts say this is a particularly important factor for tech stocks, which have risen rapidly during the pandemic and have had their valuations flattered by low interest rates.

Shares in many Wall Street high flyers have begun to pull back sharply. Cathie Wood’s Ark fund, which holds shares in companies such as Tesla, is down about a third from its February peak, while other frothy parts of the market like unprofitable tech companies and groups exposed to fluctuations in the price of bitcoin have stumbled.

Jay Powell, chair of the US Federal Reserve, has pledged to continue the central bank’s $120bn of monthly bond purchases that have boosted markets through the pandemic until the path of recovery becomes clearer.

“We expect the rapid economic recovery this year, and resultant pick-up in inflationary pressures, will prompt investors to increasingly factor in a tighter real stance of monetary policy further down the line,” analysts at Capital Economics commented in a research note.

The yield on the benchmark 10-year US Treasury added 0.01 of a percentage point to 1.615 per cent on Tuesday and has climbed from about 0.9 per cent at the start of the year.

Not all analysts are bearish about the future direction of equities, with some maintaining that higher inflation in the US will prove transient as consumer demand stabilises and supply chain bottlenecks related to industry shutdowns last year are solved.

“While investors have been worrying about inflation lately, we expect any near-term spike in inflation to be temporary and not concerned with persistent inflation,” said Andrea Bevis, senior vice-president at UBS private wealth management.

She added, however, that “investors should diversify beyond mega-cap tech companies and rotate into cyclical and value-oriented areas of the market”, such as energy producers and industrial groups, “that should continue to benefit from higher yields and a broadening economic recovery”.

#techAsia — Weekly newsletter

Your crucial guide to the billions being made and lost in the world of Asia Tech. A curated menu of exclusive news, crisp analysis, smart data and the latest tech buzz from the FT and Nikkei