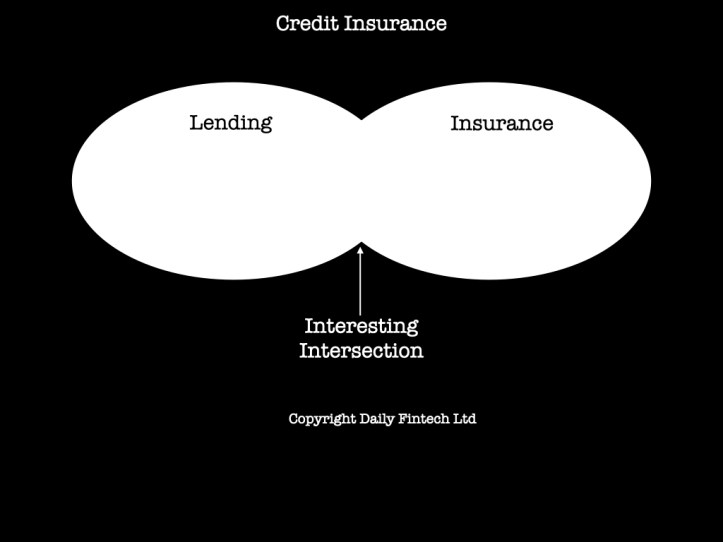

The Increasing Importance of Credit Enhancement Insurance

Need to get a leveraged project of the ground? You may well need the help of the worldwide insurance market. Credit enhancement insurance and other techniques are increasingly being used to help oil the wheels of capital allocation and spreading the risk. Those of you who regularly read my Lending column on Fridays will know…

Read more