Stablecoin News for the week ending Wednesday 8th December.

Brave, smart or lucky?

Here is our pick of the 3 most important Stablecoin news stories during the week.

Last week we saw further reflection on the appropriate role of regulators. When do they jump in and how?

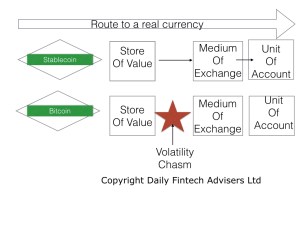

Tether, Circle, Dai are all private sector issued stablecoins. Are they safe? Do they have to be issued or at a minimum regulated by a Government to be safe? This article from the Economist looks at the history of private sector issued money and what we could learn.

The key takeaway: “if innovation is not to be smothered, the quality of regulation matters”.

The explosion in stablecoins revives a debate around “free banking” | The Economist

Meanwhile two private sector banks have announced they are getting on with it by using some novel technology that combines some of the concepts of Crypto (decentralised and public ledgers) with the existing Bank trust systems.

Shinhan Bank in Korea and Standard Bank in South Africa are to test the use of stablecoins for cross-border remittances using the decentralised public ledger Hedera Hashgraph.

Hashgraph is a distributed, public ledger technology that has been described as an alternative to blockchains. The hashgraph technology is currently patented, and the only authorized ledger is Hedera Hashgraph. The native cryptocurrency of the Hedera Hashgraph system is HBAR.

Under the Proof of Concept, both banks will issue new stablecoins pegged to their respective national currencies and allow users to purchase the stablecoins for international payments with users of the other bank.

Standard Bank and Shinhan Bank to test cross-border stablecoins (finextra.com)

Finally, an interesting paper from the ECB. What happens if a CBDC is wildly successful or perhaps even worse is a dismal failure.

“Finding an adequate functional scope – neither too broad to crowd out private sector solutions, nor too narrow to be of limited use – is challenging in an industry with network effects, like payments.”

Central Bank Digital Currency: functional scope, pricing and controls (europa.eu)

So in summary, last week we saw some understanding on the dangers of regulation killing innovation and regulators building things that no one wants, at the same time two Banks got together to try something innovative which may or may not fail.

Only the brave, smart and sometimes lucky will survive.

___________________________________________________________________________________________________________

Alan Scott is an expert in the FX market and has been working in the domain of stablecoins for many years.

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

For context on stablecoins please read this introductory interview with Alan “How stablecoins will change our world” and read articles tagged stablecoin in our archives.

____________________________________________________________________________________________________________

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just US$143 a year (= $0.39 per day or $2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.