Stablecoin News for the week ending Wednesday 6th October.

Will regulations enable Crypto to go mainstream?

Here is our pick of the 3 most important Stablecoin news stories during the week.

The belief is widely held that regulations and regulators build trust, which the mainstream requires if they are to adopt this bright, shiny new technology (which is by nature trustless)!

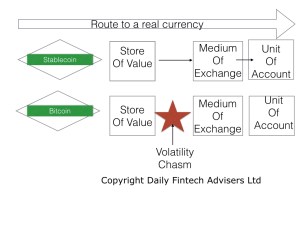

Stablecoins are the most obvious starting point. They are the on-off ramps of Crypto and as they are by nature tied to Fiat are a relatively easy and less controversial place to start.

This week we saw the Biden administration signal that it wants crypto companies that issue stablecoins to become banks. (It’s unclear how it will enforce some of its recommendations, a potential weakness of a coming report from a group of senior regulators). Banks and stablecoins are presently overseen at the State level, so expect a major bun fight towards the end of October.

Biden Administration Seeks to Regulate Stablecoin Issuers as Banks – WSJ

Meanwhile, the Fed indicated it also supported a stablecoin first approach to regulation, leaving Crypto (for now) alone. Most recently, China’s central bank prohibited all local organizations from dealing with anything even remotely connected to crypto.

This caused disruptions in the market. At the same time, multiple prominent names urged the US to take the complete opposite stance on crypto.

And it seems this is precisely what the States plans to do, at least according to the Federal Reserve Chairman Jerome Powell. During yesterday’s House Financial Services Committee meeting, he said the government has no intentions to ban cryptocurrencies.

However, he still asserted that some digital assets, stablecoins in particular, have to be regulated.

The US Has No Intentions to Ban Bitcoin, Said Fed Chair Powell (cryptopotato.com)

Then we hear the darker side, actually let’s use regulations to slow adoption down or even stop it. Why? It could be too successful and become a systemic risk (like we don’t have that with the current system)!

The Washington-based IMF said the 10-fold increase in the market value of crypto assets – digital or virtual currencies – to more than $2tn since early 2020 required more active and collaborative supervision by governments.

The IMF also highlighted potential problems with the four-fold increase in the supply of stablecoins – cryptocurrencies that aim to peg their value, usually against the US dollar – to $120bn (£88bn) during 2021.

“Given the composition of their reserves, some stablecoins could be subject to runs, with knock-on effects to the financial system. The runs could be driven by investor concerns about the quality of their reserves or the speed at which reserves can be liquidated to meet potential redemptions.”

Last month, China made transactions in cryptocurrencies illegal, but the IMF said emerging and developing countries appeared to be leading the way with their use. This risked damaging the ability of central banks to effectively implement monetary policy and potentially created financial stability risks, it added.

So there we have, literally, both sides of the coin, good regulation (not copy and paste from the existing system) could add a trust and protective layer to the Crypto and stablecoin ecosystem. But keep an eye out that the state is not just protecting it’s monopoly while cynically preaching safety for the common man.

____________________________________________________________________________________________________________

Alan Scott is an expert in the FX market and has been working in the domain of stablecoins for many years.

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

For context on stablecoins please read this introductory interview with Alan “How stablecoins will change our world” and read articles tagged stablecoin in our archives.

____________________________________________________________________________________________________________

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just US$143 a year (= $0.39 per day or $2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.