Stablecoin News for the week ending Wednesday 6th April.

Here is our pick of the 3 most important Stablecoin news stories during the week.

Is your CBDC interoperable with others and does it have incentives!

Central Banks are trying to make 2022 the year they figure out exactly what sort of CBDC we should have.

In a speech before the European Parliament on Wednesday (March 30), Fabio Panetta, member of the board of the European Central Bank (ECB), said that several central banks around the world, including the Federal Reserve, the Bank of England (BOE) and the ECB, are discussing how to align their projects to have interoperable central bank digital currencies (CBDCs).

Panetta delivered a speech summarising the benefits of a digital euro for the region but emphasising that there are still many questions that need to be answered at the political level such as the level of privacy and anonymity, the role of the banking system to hold and distribute retail CBDCs — or even if users should be discouraged from having large amounts of digital euros, for instance by penalising large deposits, to prevent crowding out private initiatives.

ECB, Fed, BoE Work on an Interoperable CBDC | PYMNTS.com

A proposed answer to this problem is in a Barclays’ Bank paper which sets out a methodology for the mitigation of potential fragmentation risk through an architecture that places CBDC and commercial bank money on a similar footing.

By adopting and extending the Bank of England’s ‘platform model’ for a potential UK CBDC, it considers how a central bank core ledger, an interface to that ledger, and authorised Payment Interface Providers which allow users access to CBDC, would function in this proposed architecture.

Barclays addresses potential CBDC fragmentation in new paper (finextra.com)

Meanwhile in the DeFi world, TrueUSD (TUSD) and Balancer (BAL) Automated Market Maker (AMM) partnered up with Polygon to offer liquidity providers with TUSD and BAL rewards from a stablecoin pool incentive program to add TUSD-DAI-USDC-USDT liquidity to the Polygon ecosystem.

So in summary, Central Banks are trying to figure out interoperability and other difficult questions around privacy while in DeFi land they are throwing out incentives for ever greater adoption.

___________________________________________________________________________________________________________

Alan Scott is an expert in the FX market and has been working in the domain of stablecoins for many years. Twitter @Alan_SmartMoney

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

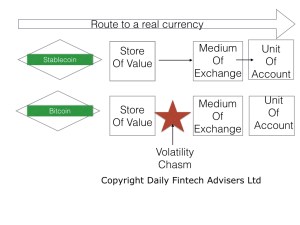

For context on stablecoins please read this introductory interview with Alan “How stablecoins will change our world” and read articles tagged stablecoin in our archives.

____________________________________________________________________________________________________________

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just US$143 a year (= $0.39 per day or $2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.