Stablecoin News for the week ending Wednesday 30th June.

The Empire is so preoccupied it can’t strike back!

Here is our pick of the 3 most important Stablecoin news stories during the week.

Last week we saw a flurry of activity from the Financial Industry Establishment as it struck back at the upstart Crypto and Stablecoin communities. This week we see a group of stories that makes you wonder if they are even capable of stopping or taming this new industry.

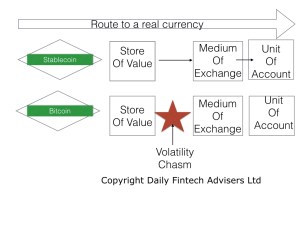

Firstly, the BIS consultation on what level of leverage a Bank should be able to have for Crypto Assets. Last week we noted how the BIS was proposing such a high level and at a cost that in effect meant no Bank could afford to trade Crypto in a proprietary sense. But maybe, traditional banks are simply not set up operationally or technologically to hold on-balance sheet assets, such as bitcoin, that settle in minutes with irreversibility.

In the meantime, the supply of stablecoins on crypto exchanges has surged to a historic peak, meaning plenty of funds sitting on the sidelines waiting to purchase Crypto on the dip, according to an analytics expert.

Stablecoin Supply on Exchanges Hits ATH of $17 Billion, Here’s What It Means for BTC

Also, this week the Monetary Authority of Singapore (MAS) has teamed up with the International Monetary Fund (IMF), World Bank and others to launch a competition where entrants must tackle 12 unresolved challenges posed by central bank digital currencies (CBDCs). These issues or unresolved challenges are significant to resolve and show that CBDC’s are still very much in the concept stage.

Singapore’s Central Bank, IMF Launch Global Challenge for CBDC Solutions – CoinDesk

Then we had this alarming report, that with all the money printing by Central Banks, we are now at the beginning of the first bursting of a global sovereign debt bubble in 100 years and the first currency system shift in 50 years.

So in summary, does the existing Financial Industry have enough on it’s plate without also having to reinvent itself at the same time?

________________________________________________________________________________________________________

Alan Scott is an expert in the FX market and has been working in the domain of stablecoins for many years.

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

For context on stablecoins please read this introductory interview with Alan “How stablecoins will change our world” and read articles tagged stablecoin in our archives.

________________________________________________________________________________________________________

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just US$143 a year (= $0.39 per day or $2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind.