Stablecoin News for the week ending Wednesday 23rd March.

Here is our pick of the 3 most important Stablecoin news stories during the week.

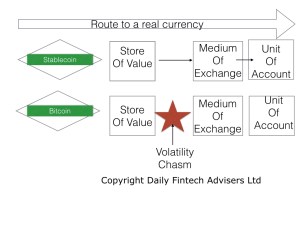

No currency is an island!

Unlike in Roman times, without interchangeability or exchange a currency looses a lot of its value or utility.

The BIS pushed on this theme with Project Dunbar that this week supposedly proved that financial institutions could use CBDCs (actually multiple CBDCs) issued by a number of participating central banks to transact directly with each other on a shared platform. This has the potential to reduce reliance on intermediaries and, correspondingly, the costs and time taken to process cross-border transactions.

- Project Dunbar developed two prototypes for a shared platform that could enable international settlements using digital currencies issued by multiple central banks.

- The platform was designed to facilitate direct cross-border transactions between financial institutions in different currencies, with the potential to cut costs and increase speed.

- The project identified challenges of implementing a multi-CBDC platform shared across central banks and proposes practical design solutions to address them.

Then we have the wild boys of the stablecoin sphere, Algorithmic stablecoins are inherently fragile. These uncollateralized digital assets, which attempt to peg the price of a reference asset using financial engineering, algorithms, and market incentives, are not stable at all but exist in a state of perpetual vulnerability. Iterations to date have struggled to maintain a stable peg, and some have failed catastrophically. This Article argues that algorithmic stablecoins are fundamentally flawed because they rely on three factors which history has shown to be impossible to control. First, they require a support level of demand for operational stability. Second, they rely on independent actors with market incentives to perform price-stabilising arbitrage. Finally, they require reliable price information at all times.

Built to Fail: The Inherent Fragility of Algorithmic Stablecoins by Ryan Clements :: SSRN

In the meantime, the Arab Monetary Fund (AMF) has named decentralised payments network RippleNet as a feasible alternative to central bank digital currencies (CBDCs).

RippleNet’s XRP named as Alternative to CBDCs by Arab Monetary Fund (watcher.guru)

So in summary, we are seeing more evidence that the world of stablecoins is developing into a multi coin verse rather than the current Fiat one which is dominated by one (according to BIS some 80% of all wholesale trades have the US Dollar on one side).

___________________________________________________________________________________________________________

Alan Scott is an expert in the FX market and has been working in the domain of stablecoins for many years. Twitter @Alan_SmartMoney

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

For context on stablecoins please read this introductory interview with Alan “How stablecoins will change our world” and read articles tagged stablecoin in our archives.

____________________________________________________________________________________________________________

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just US$143 a year (= $0.39 per day or $2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind