Stablecoin News for the week ending Wednesday 23rd February.

Here is our pick of the 3 most important Stablecoin news stories during the week.

In an unstable world, Stablecoin market growth continues as Crypto goes sideways.

With Russia menacing Ukraine and the world potentially facing the largest conflict since World War 2, our small sector of stablecoins is growing and working as intended, stable!

Cryptocurrencies, along with stock markets, fell amid warnings from Western leaders that a Russian invasion of Ukraine was imminent. Safe-haven assets including gold, U.S. Treasuries and stablecoins benefited as investors stepped out of the market and stood on the sidelines to see what would happen next.

Russia-Ukraine Tensions Wipe $160 Billion Off Crypto Markets; Stablecoin Demand Rises (coingape.com)

The rapid growth in the stablecoin sector was further highlighted when the number 2 stablecoin provider, Circle announced it has doubled it’s valuation to USD$ 9 billion in under 12 months as it prepares for an IPO.

Tether is still the market leader at 78 billion issued although it does not dominate like it once did as the overall market in general continues to grow at a rapid pace.

Stablecoin Provider Circle Hits $9B Valuation After New SPAC Deal – Decrypt

In the meantime Government stablecoins or CBDC’s are a mixed story. While China is increasing the use of it’s implementation with athletes at the winter Olympics having access to the digital yuan, the western world is all very much in the research stage.

Lael Brainard, a member of the Federal Reserve’s Board of Governors, encouraged the United States to be a leader in research and policy regarding central bank digital currencies, or CBDCs, due to potential international developments.

“It is prudent to consider how the potential absence or issuance of a U.S. CBDC could affect the use of the dollar in payments globally in future states where one or more major foreign currencies are issued in CBDC form,” said Brainard. “A U.S. CBDC may be one potential way to ensure that people around the world who use the dollar can continue to rely on the strength and safety of U.S. currency to transact and conduct business in the digital financial system.”

Fed’s Lael Brainard hints at US playing a lead role in development of CBDCs (cointelegraph.com)

So in summary, as the world looks decidedly less stable, private sector stablecoins continue to perform their function and grow in value terms at a remarkable rate, while the public sector version or CBDC is (with the big exception of China) stuck in research and discussion.

____________________________________________________________________________________________________________

Alan Scott is an expert in the FX market and has been working in the domain of stablecoins for many years.

We have a self imposed constraint of 3 news stories per week because we serve busy senior Fintech leaders who just want succinct and important information.

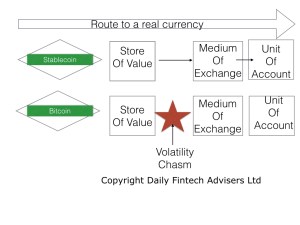

For context on stablecoins please read this introductory interview with Alan “How stablecoins will change our world” and read articles tagged stablecoin in our archives.

____________________________________________________________________________________________________________

New readers can read 3 free articles. To become a member with full access to all that Daily Fintech offers, the cost is just US$143 a year (= $0.39 per day or $2.75 per week). For less than one cup of coffee you get a week full of caffeine for the mind