Spanish steps to Europe’s mobile consolidation

Three is the magic number for European telecoms operators, and Spain is leading a fresh round of consolidation of the fragmented market.

Orange and MasMovil said on Tuesday they were in exclusive talks to combine their Spanish businesses through a €19.6bn joint venture. If they reach agreement and regulators approve, Spanish players would be reduced from four to three.

Spain’s largest operator currently is Telefónica, followed by Orange, and Vodafone. MasMovil, the fourth biggest operator, was taken private in 2020 after a leveraged buyout by private equity groups KKR, Providence Equity Partners and Cinven.

Anna Gross reports the news will be perceived as a blow to Vodafone, which had also been talking to parties in Spain about possible deals for its Spanish business.

Vodafone chief executive Nick Read has been under pressure from activist investor Cevian Capital to seek deals more aggressively. He has identified Spain, Italy and the UK as being ripe for a reduction from four to three, and Portugal to go from three to two operators. Orange has said the French market would benefit from a four-to-three move.

The European Commission has seen things differently, believing the current level of competition is needed to keep prices down and give consumers more choice. The operators say they need to increase their returns to justify huge investments in broadband fibre and 5G. They have been selling off their towers businesses to raise more cash lately, but also see consolidation as key.

“The [Spanish] deal is the first major test of regulators’ appetite for in-market consolidation since the pandemic,” says Kester Mann of the CCS Insight telecoms research firm. “The industry has been pinning its hopes on a more lenient stance as the value of high-quality connectivity became ever more apparent.”

It can’t count on the commission relaxing its criteria though, with the EU itself making billions of euros available for network upgrades. And any attempted consolidation can be dragged out over years by regulators’ objections. The industry just has to look at the efforts to merge Three and O2 in the UK in 2016. An EU block on the agreement was only annulled by a European court four years later, by which time, the deal was dead anyway.

The Internet of (Five) Things

1. Google buys a security company

Google is to buy US cyber security company Mandiant for $5.4bn as it looks to bolster its cloud computing business, making it the tech giant’s second-largest acquisition.

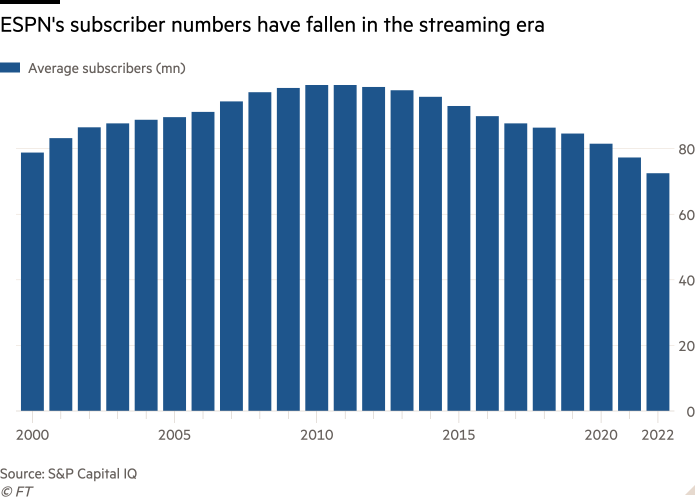

2. Disney plans makeover for ESPN

The cable sports network ESPN has been an important profit engine for Walt Disney, thanks to robust subscriber growth, high advertising rates and the industry-leading fees it charges cable providers. But its subscriber numbers have been steadily shrinking as audiences have migrated to streaming services and it is now turning to sports betting to boost revenues.

3. Amazon Web Services’ ‘painful’ outages

The head of AWS tells us recent outages at its cloud computing service were “incredibly painful” but insists that its rapid growth would not lead to wider disruption. Its infrastructure experienced two big failures late last year, including a December outage at its data centre in northern Virginia.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

4. Tigers burning bright

Several hedge funds spawned by Julian Robertson’s investment firm Tiger Management have sustained steep losses in recent months after big falls for some US tech stocks. A group of so-called “Tiger Cubs” including Chase Coleman’s $90bn-in-assets Tiger Global, Philippe Laffont’s Coatue Management and Glen Kacher’s Light Street Capital have backed a similar cohort of companies including Peloton Interactive, Zoom and Block, according to FT analysis.

5. International Women’s Day: the femtech revolution

Nikkei Asia has been looking at the different fields of femtech innovation, most of them involving healthcare. For example, Singapore’s EloCare is developing a wearable product that monitors a woman’s body temperature, blood pressure and other variables to provide “personalised data treatment for menopause”. The aim is that users will be able to monitor their hot flushes and other symptoms, then see a doctor armed with data about their condition, in the hope of receiving a more accurate diagnosis and appropriate treatment.

Tech tools — Apple’s new iPhone SE

Apple’s “Peek Performance” event is currently under way and the first hardware announcement is that the iPhone 13 is now available in two new shades of green! Yes, try to contain your excitement. Next up, the new iPhone SE is more interesting, The most affordable iPhone will now have the faster A15 Bionic chip from the iPhone 13. It will be available in three colours — Midnight, Starlight and [Product] Red — from $429. The 4.7in retina display is protected by tougher glass, there is 5G connectivity and the A15 processor means better battery life and computational photography to improve the 12MP camera. More from the event in Wednesday’s #techFT.