Shares in TikTok rival Kuaishou tumble as user spending falls

Shares in ByteDance’s main competitor in China tumbled after the company’s losses widened on growing signs that users in the country are spending less on its live-streaming services.

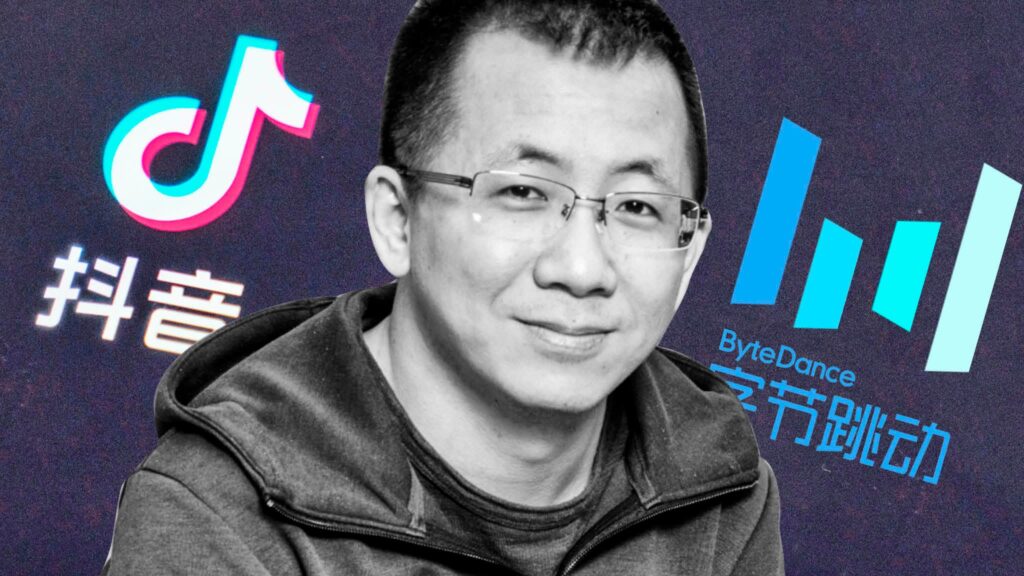

Kuaishou’s short video app faces stiffening competition from ByteDance’s Douyin, the Chinese version of TikTok, and online shopping groups such as Alibaba and Pinduoduo which have also pushed into selling goods via live streaming.

The company’s shares fell 11.5 per cent in Hong Kong on Tuesday, erasing $14bn from Kuaishou’s market capitalisation. The initial public offering of Kuaishou, which is backed by Chinese internet group Tencent, raised more than $5.4bn in February.

Kuaishou’s results come as Beijing steps up scrutiny of the country’s tech sector. The company is one of the almost three dozen tech groups that have been told to fix anti-competitive practices. Regulators have also rolled out new rules to control live streaming content and limit some tipping of video hosts.

Kuaishou earns a significant part of its revenue by taking a cut of the money users pay to shower small gifts on live streaming hosts, such as virtual beer stickers for Rmb1.50 ($0.23) or “golden dragons” for Rmb1,400.

Four years ago, it earned 95 per cent of its revenues this way but in the three months to March, such spending by users fell 20 per cent year on year. Sales of virtual gifts contributed only 42.6 per cent of total revenue for the quarter, according to Kuaishou’s earnings report released late on Monday.

Growth in the company’s advertising business helped offset the decline, with revenue in this segment up 161 per cent year on year. Advertising contributed 50.3 per cent of total revenue during the quarter.

Kuaishou’s total revenue rose 36.6 per cent year on year to Rmb17bn ($2.65bn) but sales for all three of its business lines came in below research group Bernstein’s estimates. The miss was particularly large for the business line that holds Kuaishou’s ecommerce business.

The company’s operating loss expanded to Rmb7.3bn for the quarter, from Rmb5bn a year earlier.

The earnings figures prompted Wall Street banks including Morgan Stanley to cut their share price targets for Kuaishou. Analysts at Morgan Stanley said Kuaishou’s increasing investment, larger expected loss for the year and weaker live streaming revenue contributed to its target price cut.

Live streaming ecommerce, in which online hosts tout products to users, has been booming in China as the Covid-19 pandemic meant shoppers stayed at home and made purchases on their smartphones.

But competition with Douyin, Alibaba, Pinduoduo and JD.com is fierce.

“We remain more cautious about Kuaishou’s live streaming ecommerce growth,” said Robin Zhu, an analyst at Bernstein.

Bernstein also pointed to Kuaishou’s ballooning sales and marketing expenses, which totalled 69 per cent of revenue. The research group estimated that the amount Kuaishou paid to acquire each new user increased to Rmb65 per user during the period, up from Rmb55 in the fourth quarter.

Kuaishou said it was investing to grow its user base and engagement. Monthly users of its apps hit 519.8m during the quarter, up from 495m a year earlier.